Using our strong cash generating capacity to strengthen our financial base and secure funds for growth with M&A and business investment

Boosting top-line growth to create a virtuous cycle of rising market share and profit margins

The FY2023 financial targets in the New Medium-Term Plan are based on ongoing expansion of our business portfolio to generate organic growth. The targets are challenging, but we believe our Group’s insatiable desire for growth will enable us to achieve them. The core strategies in the plan aim for both organic and inorganic growth through M&A.

Establishing sustainable growth will require aggressive M&A along with capital expenditure and R&D investment for future growth. We will leverage our strong ability to generate cash flow to create the funds for these investments in growth.

Investments to increase marginal profit from revenue growth will be a specific focus. We will also seek to boost operating profit by increasing market share, which will allow us to increase prices at strategic points in time and reduce costs through bulk procurement of raw materials. Over half of revenue goes to raw material costs; as such reducing the raw materials contribution cost (RMCC) ratio significantly contributes to improving the operating profit margin. We will seek to thoroughly control costs by using our global raw materials procurement capability and our considerable revenue flow, which is roughly one trillion yen annually, to leverage the economies of scale.

Achieving high organic growth

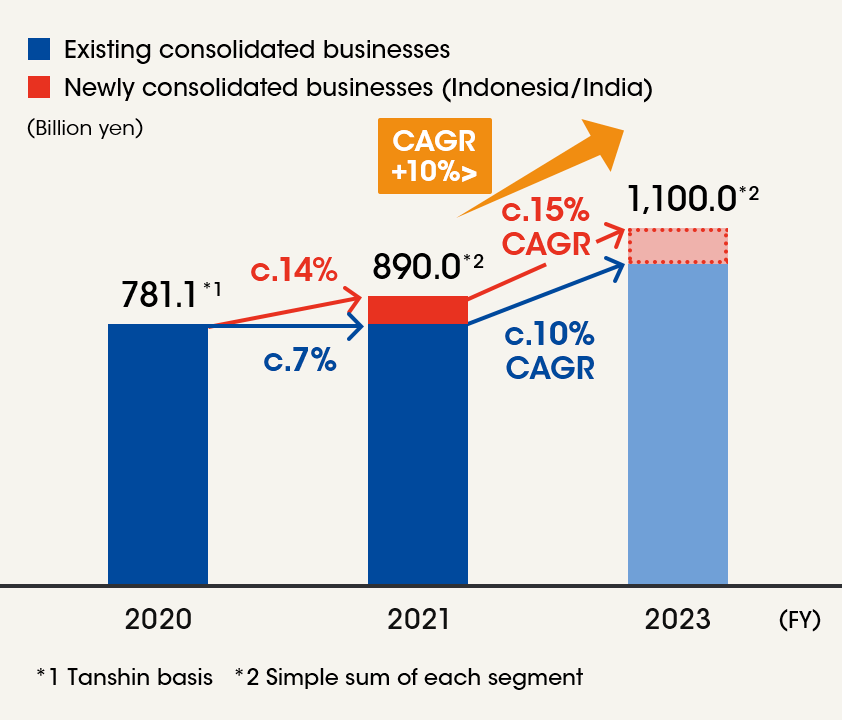

For existing businesses, we will aim to maintain steady growth mainly in China and Asia with the aim of attaining CAGR of around 10% (See Figure 1.)

For the recently acquired Indonesia business, we will seek to accelerate business growth by capturing the rising demand in the region and increasing market share with a target CAGR of 15%.

We project the combined revenue from the existing businesses and the newly consolidated Indonesia business to grow from ¥890 billion in FY2021 to ¥1,100 billion in FY2023 with a CAGR above 10%.

Increasing profit through business growth and fixed cost reduction

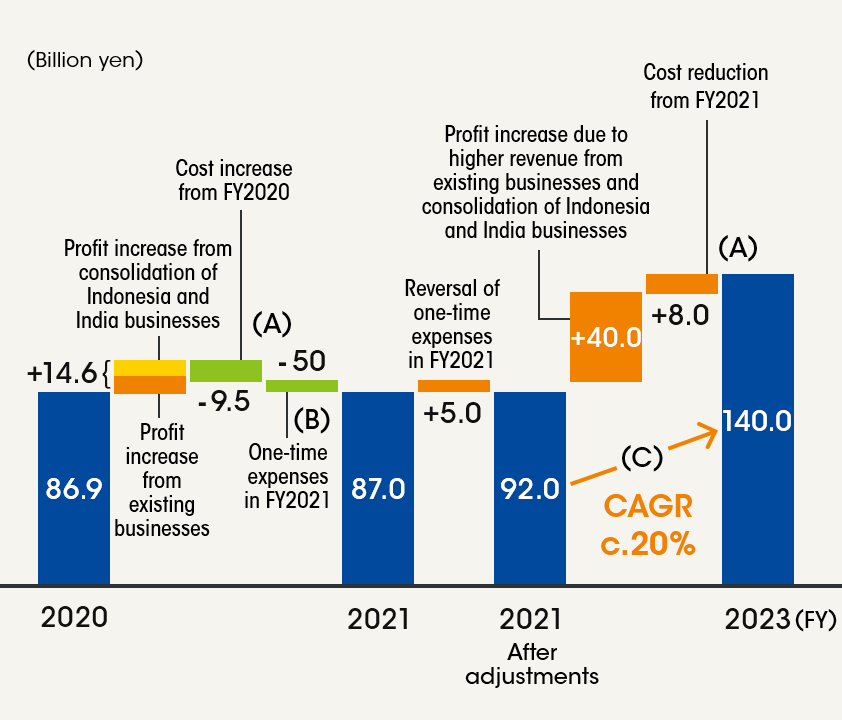

In FY2021, as shown in Figure 2, we plan to increase spending on supply chain reforms, DX implementation, and infrastructure system development, for an overall increase of around ¥9.5 billion from FY2020. This spending will gradually decrease and we expect the streamlined operations to lower FY2023 costs to the FY2020 level (See Figure 2 (A)). We have also recorded one-time expenses, including a stamp tax, of roughly ¥5.0 billion related to the acquisition of 100% ownership of the Asian JVs (See Figure 2 (B)).

We aim to achieve operating profit of ¥140 billion in FY2023, which we will accomplish by increasing profit by ¥40 billion through increased revenue from both existing businesses and newly consolidated businesses and by reducing costs by ¥8 billion (See Figure 2 (C)).

Boosting cash flow generation ability and allocating capital for growth

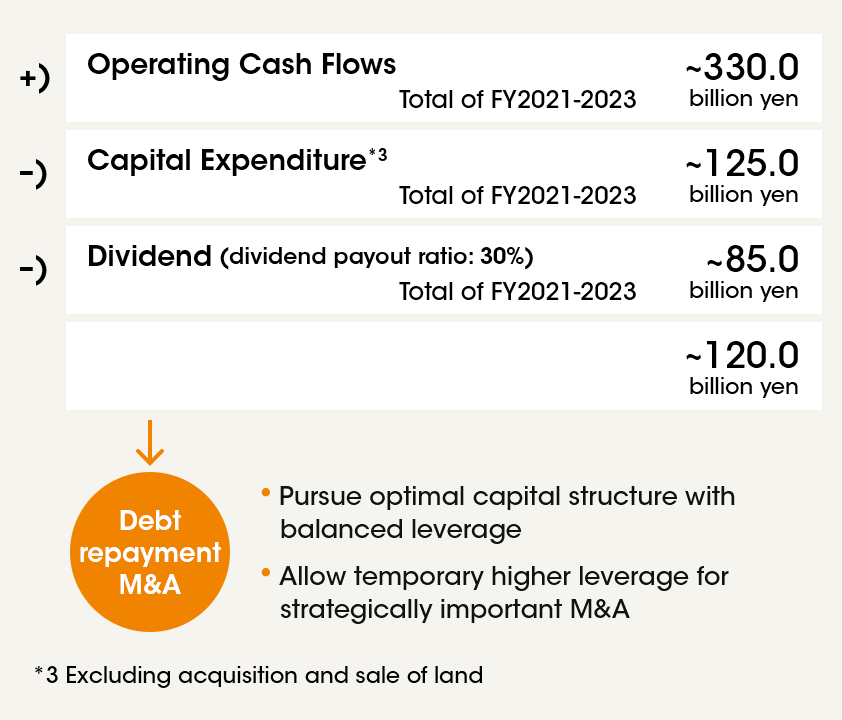

The paint and coatings business, in contrast to an industry like semiconductors, has relatively low capital investment requirements without large-scale initial investments or equipment replacement costs. As a result, the paint industry is characterized by very stable cash flows. In addition, the acquisition of 100% ownership of the Asian JVs has eliminated profit outflows, which has significantly boosted our ability to generate cash flow. Our financial strategy is designed to leverage these advantages.

Our financial strategy is to generate around ¥330 billion in operating cash flows over the three-year period from FY2021 to FY2023. We plan to allocate ¥85 billion for dividend payments, around ¥125 billion for capital investment for future growth, and the remaining ¥120 billion for debt repayment and M&A (See Figure 3).

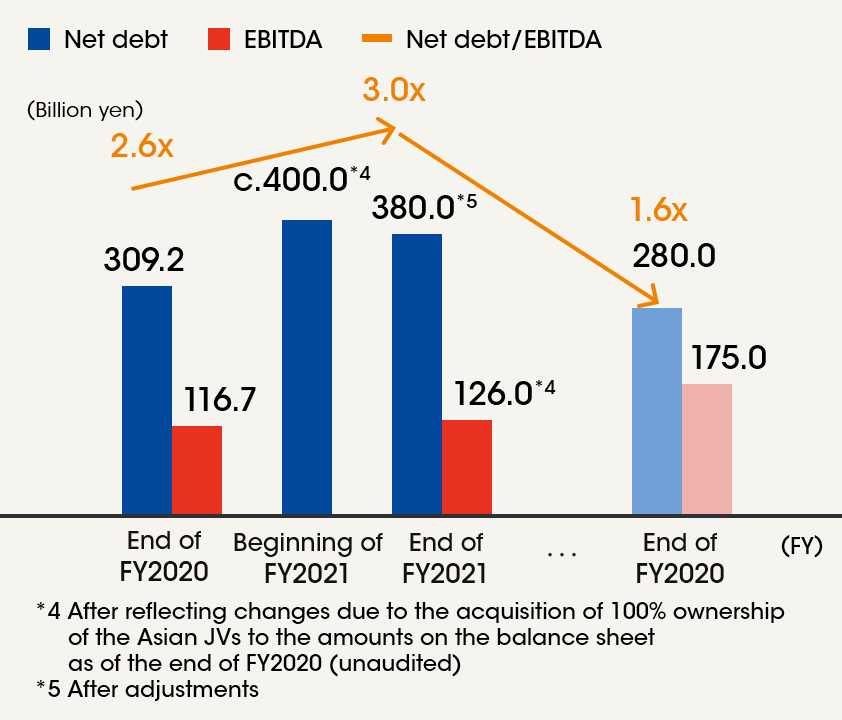

If we do not carry out any M&A and the ¥120 billion earmarked for M&A is allocated to debt repayment, even though net debt will increase in FY2021 from the borrowing of ¥100 billion procured to finance the acquisition of 100% ownership of the Asian JVs, the balance of debt repayment and EBITDA growth would lower the net debt/EBITDA ratio to 1.6 times at the end of FY2023. (See Figure 4)

Under the new management structure launched in April 2021, we are reexamining the priority level and appropriateness of headquarters expenses and capital investment with the aim of surpassing the financial targets set out in the New Medium-Term Plan. We will make an announcement when the details are determined.

Increasing total shareholder return through EPS growth

Dividend increase including commemorative dividend planned in FY2021

We aim for Maximization of Shareholder Value (MSV) by prioritizing investment for future growth, raising total shareholder return (TSR) through earnings per share (EPS) growth, and maintaining financial discipline by pursuing an optimal capital structure with balanced leverage while allowing for temporary higher leverage for strategically important M&As.

As part of our effort to raise TSR, our policy is to maintain steady and consistent dividend payments while taking full account of factors including the earnings trend, investment opportunities, and the dividend payout ratio. We currently aim to maintain a dividend payout ratio of 30%.

In FY2021, we plan to pay an annual dividend of ¥10 per share (after the stock split), including the special dividend of ¥1 per share to commemorate the 140th anniversary of founding.

(Figure 1) Revenue growth rate

(Figure 2) Operating profit gap analysis

(Figure 3) Projected capital allocation for FY2021-2023

(Figure 4) Changes in net debt/EBITDA

- Integrated Report 2021 (Digital Edition)