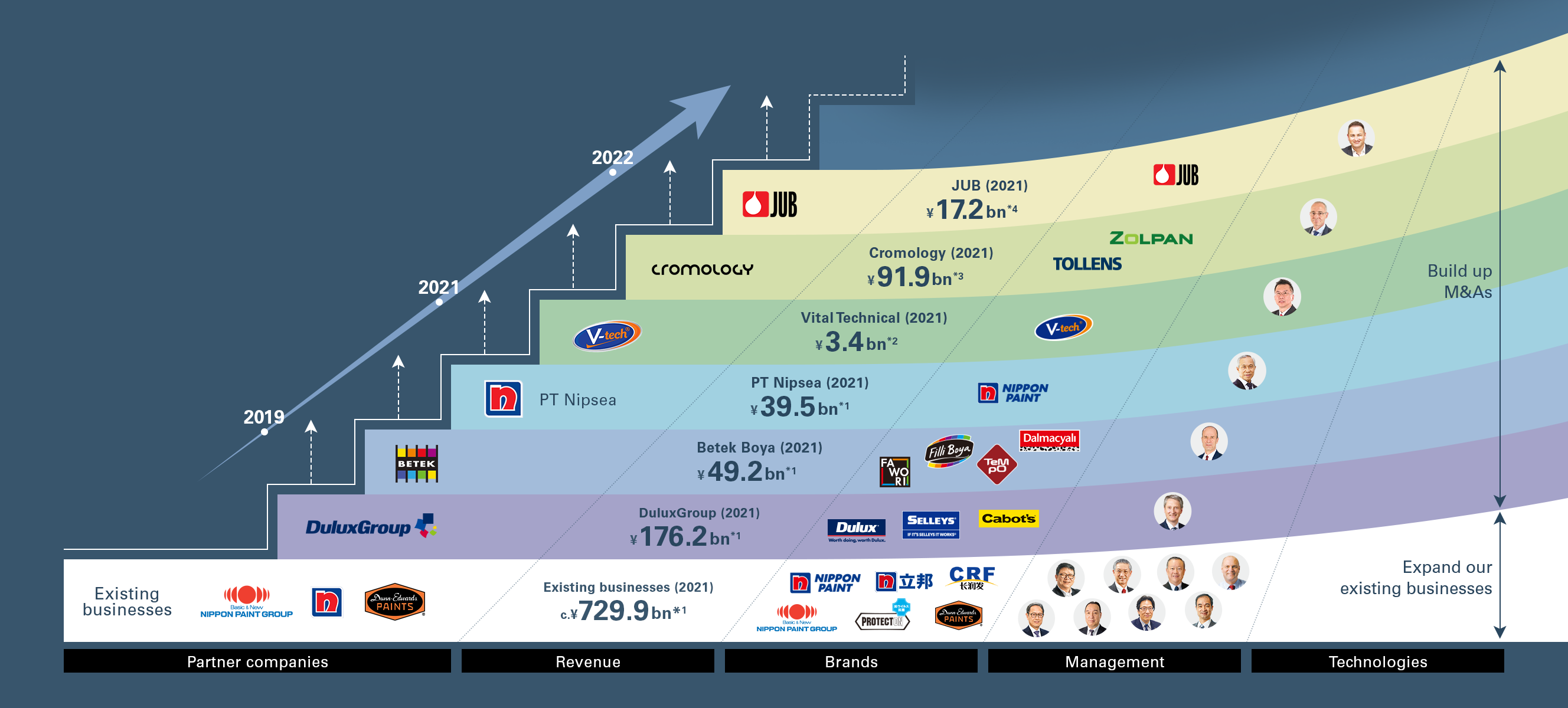

Our medium- and long-term growth model as an Asset Assembler

As a unique Japan-based global company with MSV as its sole mission, we will relentlessly pursue growth using Asset Assembler model. Through the expansion of our existing businesses and aggressive M&A, we will build up assets with strong brands and excellent management teams, effectuating accelerated growth with limited risk.

*1 On a segment basis (after elimination of intersegment transactions and after PPA)

*2 Vital Technical's revenue represents its nine months of revenue; Exchange rate: MYR 1=JPY 26.61

*3 Exchange rate: EUR 1=JPY 132.79; Pro forma figures

*4 Exchange rate: EUR 1=JPY 135.19

Based on Asset Assembler model, the excellent management teams in each region will pursue autonomous growth in our existing businesses by creating synergies through the proactive sharing of technical capability, distribution networks, purchasing capability, market expertise, and brands within the Group.

At the same time, we will aggressively execute M&As, thereby boosting our performance and building up newly acquired brands and human resources, which we will leverage within the Group to achieve further growth.

-

-

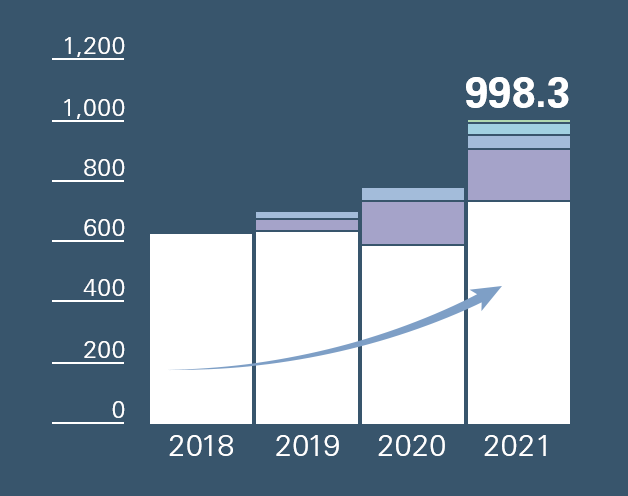

Revenue (Billion yen)

-

-

-

-

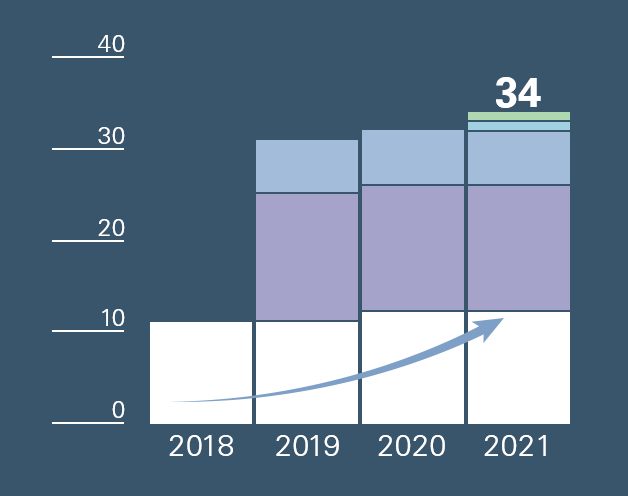

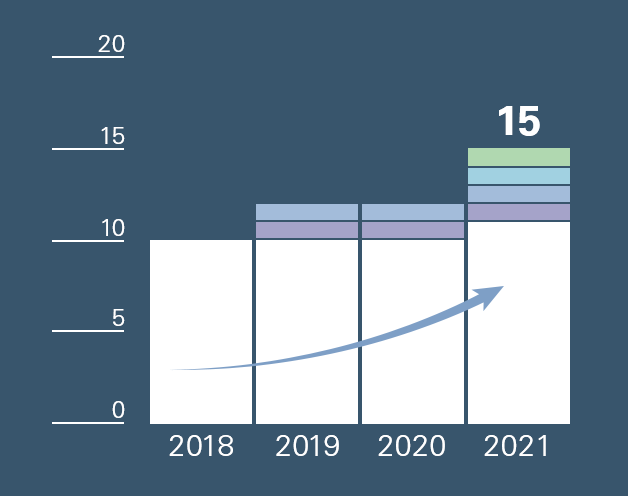

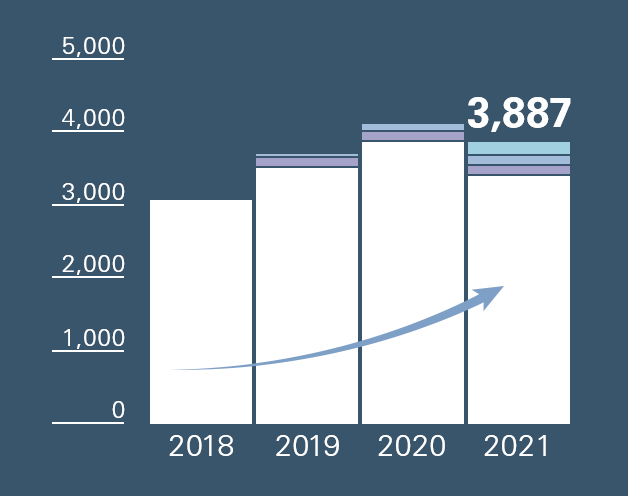

Number of key brands

-

-

-

-

Number of CEOs of key partner companies

-

-

-

-

Number of engineering talent

-

-

The five strengths underpinning our Asset Assembler model

Using Asset Assembler model and drawing on our five strengths, which are the enablers of medium- and long-term growth, we will pursue continuous earnings growth with limited risk with the goal of achieving MSV.

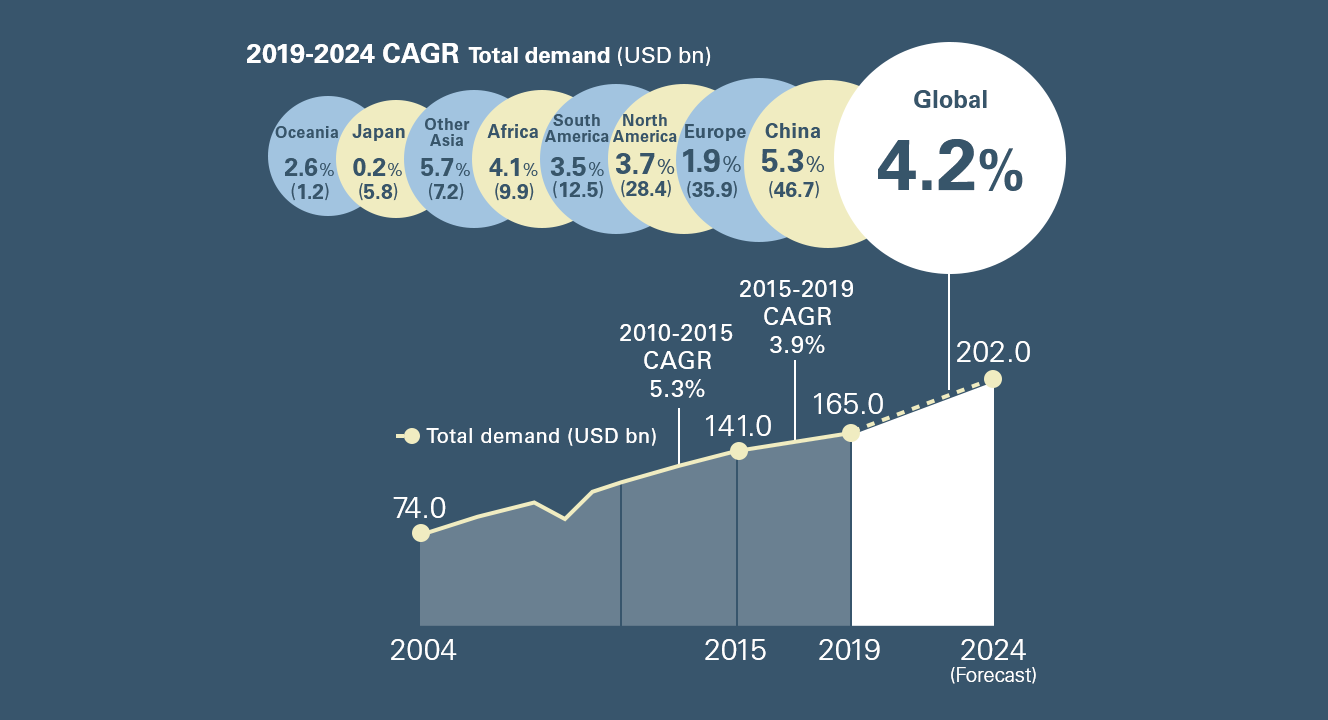

1. Focused on paint and adjacencies with significant market opportunities

Global paint demand*1,*2

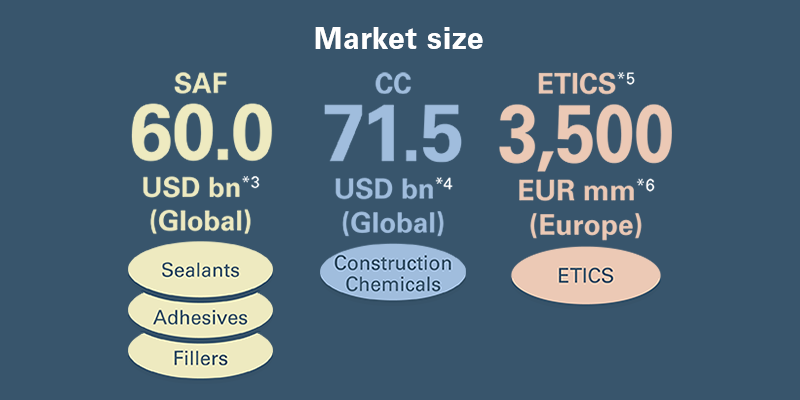

We are focusing on paint and adjacencies that have significant market size and growth opportunities driven by population growth, per-capita GDP growth, and urbanization. We have considerable expertise and knowledge in these areas. The adjacencies market, represented by the sealants, adhesives & fillers (SAF) and construction chemicals (CC) also boasts an attractive market size, and we have established a one-stop platform to supply adjacencies products, in addition to paint products.

*1 Country/region total figures are market growth forecasts in 2019.

*2 Source: ACA-published Global Market Analysis for the Paint & Coatings Industry (2019-2024) https://paint.org/market

2. Attractive risk-return profile of paint and adjacencies arena

Our powerful brands and high market share in the paint and adjacencies markets have raised entry barriers and enabled us to establish a solid leading market position. The paint and adjacencies markets are highly localized, characterized by local production for local consumption with strong local features, allowing us to minimize PMI risk through autonomous and decentralized management. These markets are also characterized by attractive returns with limited risk, where we can expect profit and cash flow generation with some degree of certainty. These characteristics make the paint and adjacencies markets well suited to M&A.

- Characteristics of the paint and adjacencies businesses

-

-

Businesses characterized by local production for local consumption Customer needs differ across countries and regions

-

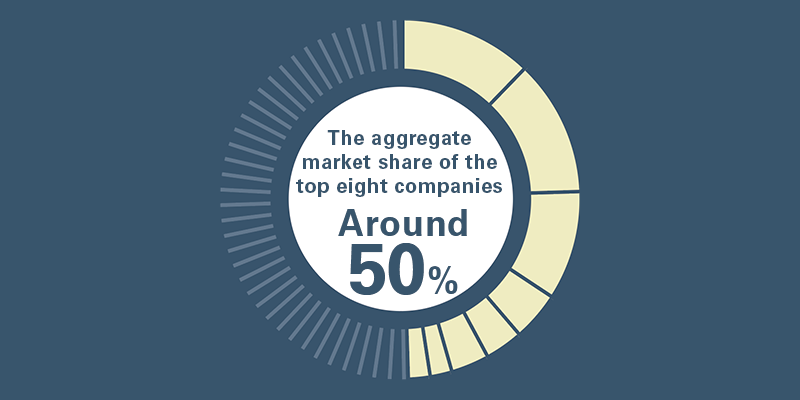

High entry barriers A small number of top-ranking brands dominate the markets

-

Adjacencies have several areas of attractive markets We supply both paint products and adjacency products in a one-stop fashion

-

*3 Source: Fortune Business Insights

*4 Source: ReportLinker

*5 External Thermal Insulation Composite System

*6 Source: European Commission Paper

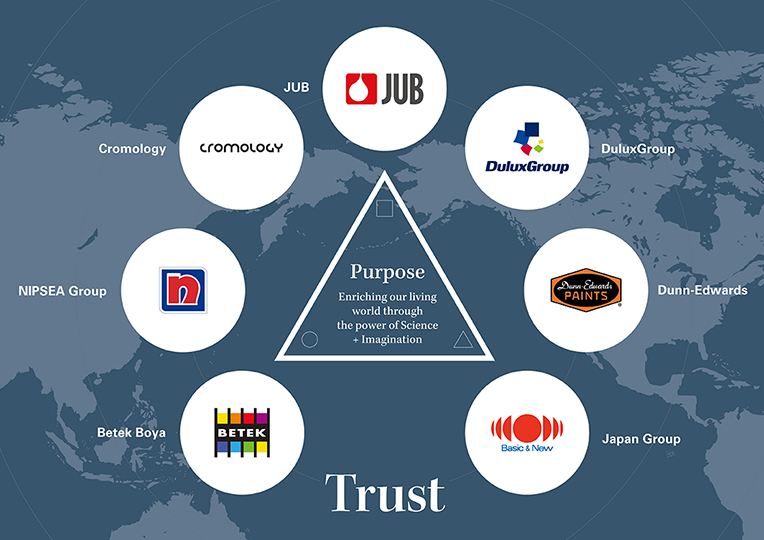

3. An assembly of talented management and strong brands

Our focus on paint and adjacencies allows us to create greater-than-expected synergies from strengths brought by an assembly of talented management and strong brands. Management of partner companies have a deep understanding of market features in their operating regions and are well versed in MSV, and with our autonomous and decentralized management, they can fully utilize their abilities. Unlike Western models featuring standardization and cost-cutting synergies, this model can leverage the strengths of our partner companies in this industry, which is highly localized. We believe this model makes joining Nippon Paint Group more attractive to potential partners as well.

4. Japan domicile enhanced competitive strengths

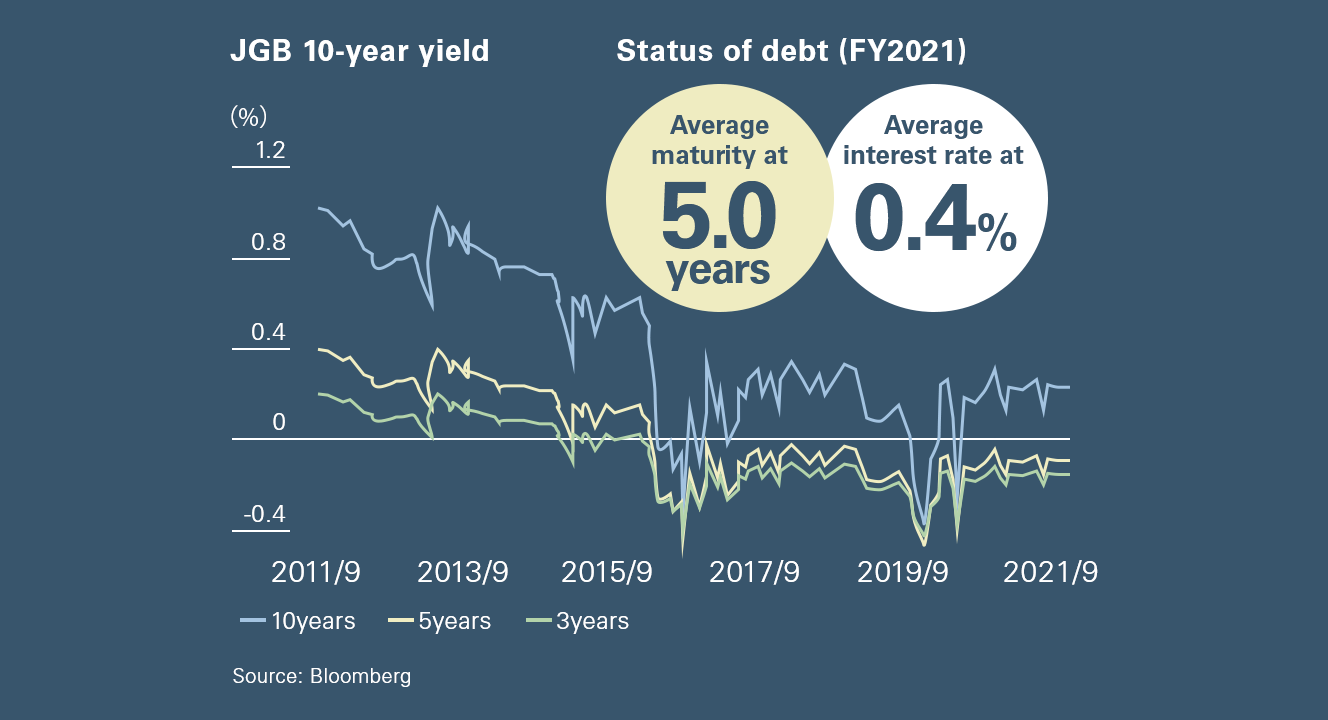

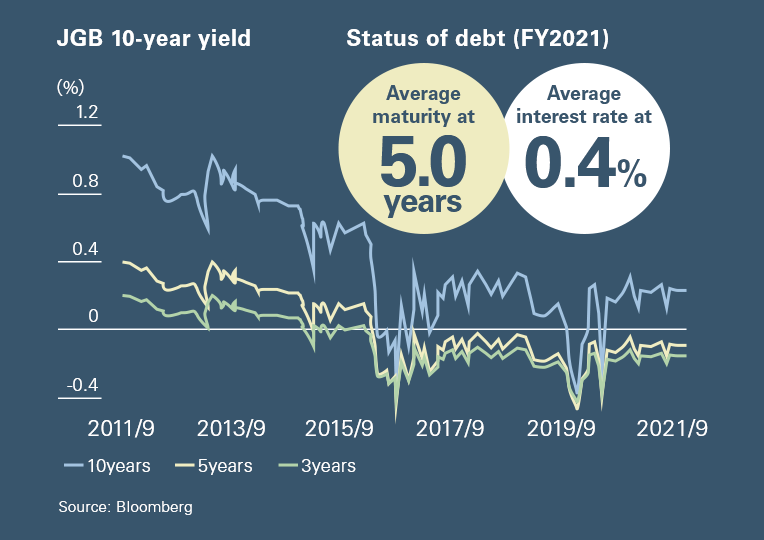

JGB 10-year yield/Status of debt (FY2021)

In Japan, which has a stable currency and safe market, we can finance at low interest rates based on long-term relationships with and strong support from financial institutions. This gives us a unique strength unmatched by our global competitors.

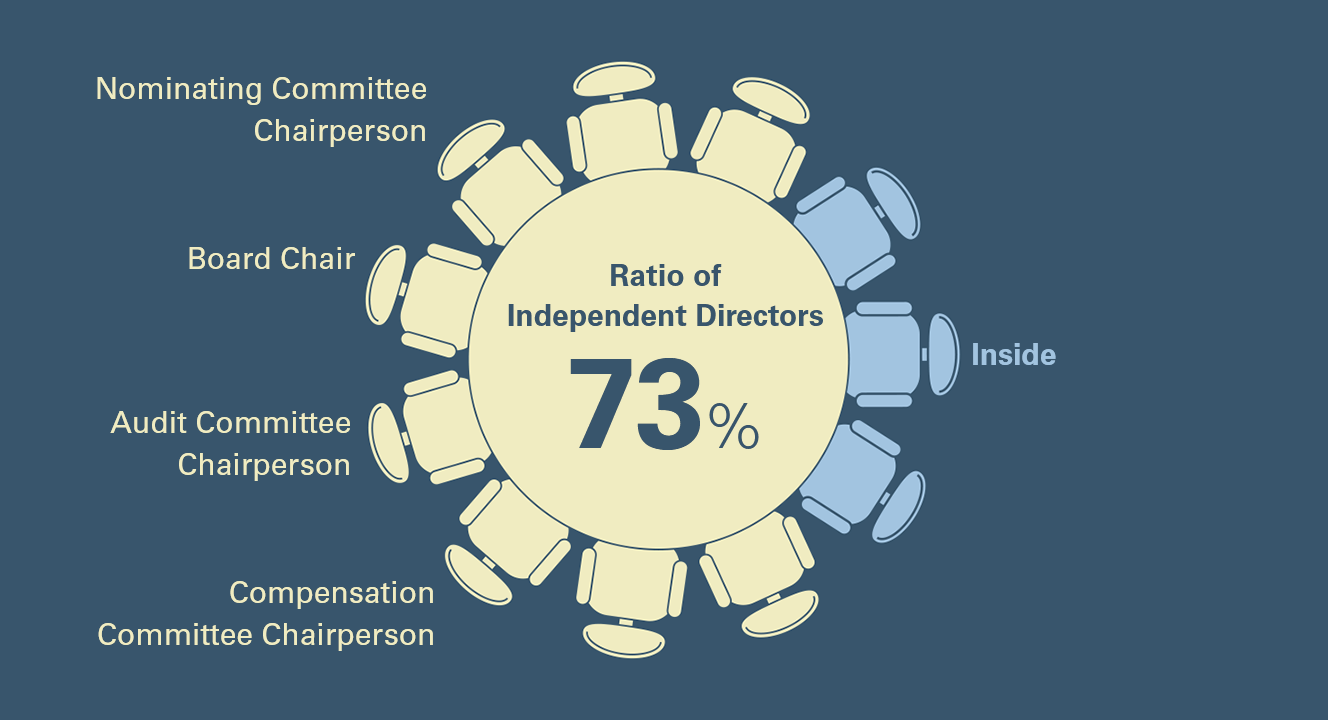

5. Advanced governance

Ratio of Independent Directors

We have established an advanced and substantively effective governance structure with Independent Directors comprising the majority of the Board of Directors. The Board of Directors shares with our major shareholder the achievement of MSV as the top decision criteria, ensuring the protection of the interests of minority shareholders. This constitutes a unique strength in our governance.

Pages related to Our Business Model

- Integrated Report 2022 (Digital Edition)