Aiming to achieve MSV by executing our medium- and long-term management strategy based on Asset Assembler model

Nippon Paint is implementing its medium- and long-term management strategy based on Asset Assembler model for pursuing MSV. On this page, Yuichiro Wakatsuki, Director, Representative Executive Officer & Co-President, explains the approach and direction of this unique management strategy along with the competitive advantages concerning M&A, financial and capital management strategy.

-

A We are implementing a strategy of expanding businesses by going beyond paint and coatings into adjacencies (Paint++) over the medium and long term. Our goal is to maximize EPS and PER by leveraging this unique business model that sets us apart from competitors.

Asset Assembler model is a model in pursuit of MSV which gives us a competitive advantage to accelerate growth at our existing businesses and additional businesses through new M&A deals.

The key point of this model is that our outstanding management team of every partner company can pursue autonomous growth within our Group through proactively leveraging various resources in our worldwide platform, such as technical capabilities, an extensive distribution network, purchasing power, know-how, and powerful brands, rather than being imposed from NPHD headquarters. This will allow the Group to acquire a broad range of expertise and create synergies within the Group. In addition, our platform is suited to bring in newly acquired companies. Our focus on the paint and adjacencies businesses, which are markets with huge growth opportunities, strong earnings and stable cash generating capabilities, will allow us to achieve faster growth with limited PMI risk following M&A. In particular, the adjacencies area including SAF (Sealants, Adhesives & Fillers) and CC (Construction Chemicals) can produce significant synergies due to overlaps with the characteristics of the paint and coatings market. Examples include the importance of distribution channels and brands for high entry barriers in the paint and coatings market.

Nippon Paint Group as a whole will become larger and stronger as we build up earnings, brands and the knowledge of newly acquired companies on top of driving steady growth of existing businesses.

This unique model is backed by the following strengths: ①Focused on paint and adjacencies with significant market opportunities, ②Attractive risk-return profile of paint and adjacency arena, ③An assembly of talented management and strong brands, ④Japan domicile enhanced competitive strengths, and ⑤Advanced governance. We will leverage these strengths for maximizing EPS and PER.

-

A Asset Assembler model is structured to produce synergies for growth at both existing businesses and newly acquired companies, which are different from the Western-style cost-cutting synergies model. This has resulted in accelerated earnings growth at these companies than prior to joinng our Group.

Generally speaking, not a few overseas M&A deals by Japanese companies result in impairment losses a few years after the acquisition. However, all our acquisitions after FY2019, when we started to conduct M&A in a more aggressive manner, have delivered better-than-expected results. This is due to the successful leverage of the five strengths underpinning Asset Assembler model.

Let me explain the key points of our M&A. The paint and coatings industry is characterized by sustained growth potential and very stable cash flow generation. In addition, companies can procure funds at lower interest rates in the current financial market in Japan compared to prior years. As a result, the market environment for M&A is very favorable.

The decorative paints market, which accounts for more than 50% of the total paint market, is characterized by local production for local consumption. As a result, the optimal business model for the decorative paints business differs significantly from country to country and market to market in terms of the procurement of raw materials, consumer preferences, distribution networks and environmental regulations.

Paint and coatings, and particularly decorative paints, have a very low threat of alternative products and strong local features. Due to these characteristics, the keys to success in the paint and coatings business are: ①strong brands, ②an extensive distribution network, and ③operations by management well versed in local markets. If we acquire the No.1 market share based on those strengths, competitors cannot easily turn the tables. Then, the No.1 player can create a virtuous cycle of further increasing its market share and earnings.

Strengths of Nippon Paint Group’s M&A based on the characteristics of the paint and coatings market are as shown in the diagram below. I cannot talk about specific target companies and regions. What I can tell you is this: the key criteria are that acquisition targets, regardless of business category and region, must contribute to MSV. In particular, acquisitions must contribute to EPS starting in the first year and have an attractive risk-return profile.Key points of the M&A strategy

Targets - Business segments: Paint (decorative/industrial) and adjacencies

- Geography: Not limited

- Potential targets: Strong corporate/product brand and excellent management team

- Fundamentals of paint and adjacencies markets e.g. population growth and urbanization create enormous growth opportunities

- No restrictions in terms of target locations as long as acquisition contributes to MSV. Distant location to be carefully examined

- Continue to build up assets leveraging strengths of our autonomous and decentralized business

Our Strengths - Financial soundness

- Ability to finance in Japan, with stable currency and stable market

- Full access to Nippon Paint Group’s platform

- Excellent management teams enabling autonomous and decentralized business model

- Stable cash generating ability and strong financial position

- Low interest rate borrowings, safety and liquidity of the stock market

- Sharing expertise, products, and technologies within the Group

- Minimize the PMI risk

Financial Discipline - Contribution to EPS

- ROIC*1>WACC*2

- Sufficient leverage capacity

- Debt financing prioritized; equity-based capital raising remains an option

- Aim to achieve EPS accretion in Year 1 after acquisition

- Take capital efficiency into consideration

- Secure financial soundness to prepare for future M&As

- EPS accretion also a must in rare case of equity financing

*1 Return on invested capital (after one-off expenses)

*2 Weighted average cost of capitalOur business model is not based on the Western-style global standardization and cost cutting program. Rather, we bring in excellent companies that have good prospects for a sustained contribution to EPS. We allow these companies to pursue autonomous growth while promoting collaboration with our partner companies worldwide and providing financial support. We believe this is the right business model for creating value over the medium and long term in the paint and adjacencies businesses, which are characterized by local production for local consumption. An overview of the successful Betek Boya acquisition is below.

We have received questions from investors about how we examine and make decisions about potential M&A deals. What is the secret to our “ability to tell good from bad?” So, let me dig a little deeper into this. The only basis of judgment about a potential deal is whether it will contribute to MSV. For instance, we never consider an acquisition merely to make us bigger, to become the company with the largest revenue in the world, or based on an egoistic agenda of management to build a big track record. Even if we become No.1 in terms of revenue, it would be meaningless if our shareholder value is impaired in the process of reaching that point.

When we examine a specific acquisition, we make a judgment after holding multifaceted discussions on the degree of PMI and other risks involved with sound vigilance at all times. This is regardless of how attractive the target company may be. For Betek Boya, for instance, we thoroughly examined opportunities for potential post-acquisition growth led by excellent management, excluding from consideration geopolitical risks including inflation risk and the financial cost. As a result, we decided that the acquisition involved risk but that the expected returns would be greater in the medium and long term. Betek Boya’s operating performance is impacted by the recent inflation and the weak Turkish lira, but its market share is nevertheless increasing. So, we are confident that the company has ample potential to deliver strong growth. Another key point is that one of our financial disciplines requires an acquired company to deliver EPS accretion starting in the first year. We never use optimistic assumptions that would rationalize acquisition synergies, hoping that the company can achieve EPS accretion three years after the acquisition.

Now, let me turn to the question about the pros and cons of delegating the management of operations to local management. As mentioned in “Letter to Investors about the Integrated Report 2022,” the Co-Presidents delegate authority to local management, which is accompanied by responsibility for delivering outcomes. Before delegating authority, we perform a study to confirm that we can Trust them based on their track records and aspirations for growth through constant communication. Sending management teams from headquarters can easily create a gap with the local staff. Replacing the local senior management with Japanese senior management could undermine the motivation of the talented local management team.

In addition to using a simple and quick decision-making approach of relying on local management, Nippon Paint Group as a whole has established a platform for supporting the local management by providing fund procurement, economies of scale, sharing of know-how, and a relationship where the local management can directly consult with the Co-Presidents. This platform enables the growth-oriented local management to fully utilize their managerial skills. In terms of governance, the local management are responsible for supervising their own companies based on our risk management framework.

The performance of the major companies we have acquired since FY2014 has been strong both in high-growth and mature markets. We have closed the acquisitions of Cromology and JUB in Europe, which are expected to contribute to our performance from FY2022 onwards.

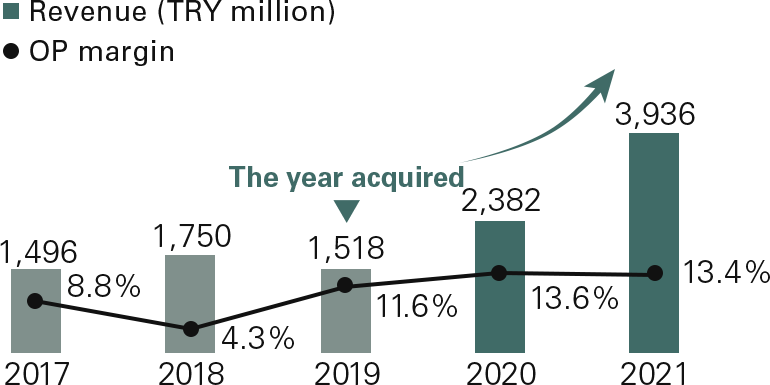

By continuing to accumulate a track record of successful M&A deals, we will demonstrate the benefits of becoming a part of Nippon Paint Group to our M&A target companies, while fostering expectations in the stock market that Nippon Paint Group can consistently deliver high growth.M&A best practice: Betek Boya

Achieved revenue growth and OP margin improvement under Nippon Paint Group

Betek Boya

Acquired in July 2019Pre-acquisition Post-acquisition CAGR 0.8%*1 61.0%*2 OP margin 11.6%

(2019)13.4%

(2021)

Synergies generated

based on our

autonomous and

decentralized management

- Betek Boya utilized NPHD’s low-cost fund-procurement capability to repay its entire high interest rate borrowings and allocated cash generated to aggressive investment in marketing activities, achieving market share gains (FY2019: 27%→FY2021: 34%*3)

- The acquisition enabled Betek Boya to share business growth know-how and best practice in developing countries as a member of NIPSEA Group and vice versa, achieving growth that significantly outperforms its pre-acquisition CAGR and the market growth

- Significantly reduced raw material cost in the first year following acquisition by sharing NIPSEA Group’s raw material procurement sources

- Stepped up its multi-brand strategy through successful launch of new brand for its premium line by using high-profile NIPPON PAINT brand

- Shared Betek Boya’s know-how in the ETICS business in the adjacency area within Nippon Paint Group, which led to faster growth of the ETICS business in our operating regions

*1 CAGR is for FY2017 to FY2019

*2 CAGR is for FY2019 to FY2021

*3 NPHD’s estimates

-

A We believe it is essential to secure stable funds through our financial strategy in order to maximize the benefits of Asset Assembler model that aims to accelerate growth through both existing businesses and M&A. We are therefore focusing on the management of a sound balance sheet by ensuring financial discipline and building an optimal capital structure.

The key elements of our financial discipline are the following: ①Prioritizing debt financing, ②Maintaining sufficient leverage capacity and enhancing engagement with financial institutions and rating agencies, and ③Equity-based capital raising remaining an option with EPS accretion as a premise. The paint and adjacencies businesses have a very high cash generation capability. In addition, our Japan domicile gives us the ability to obtain funds at low interest rates to satisfy our strong demand for financing procurement as we pursue our aggressive M&A strategy. Accordingly, we prioritize debt financing over equity-based capital raising. Maintaining sufficient leverage capacity is essential to continuing to procure finance at low cost, which requires us to maintain our earnings growth through our existing businesses and M&A. Equally important is obtaining highly positive evaluations from the understanding of financial institutions and rating agencies. The use of debt financing and leverage will contribute to maximizing EPS through M&A. Equity-based fund raising remains an option assuming that the deal is EPS-accretive, and by selecting the optimal combination of financing methods, the company will pursue unrelenting growth without setting any upper limit.

We review the status of assets as necessary in accordance with change in the market environment to ensure a sound balance sheet and the efficient utilization of assets. Taking into consideration the impact of the pandemic, we are reviewing business terms in every region and business to improve our Cash Conversion Cycle (CCC). In addition, we are taking actions to respond to future credit collection risk by recording a provision for possible credit loss on the trade receivables of some real estate developers following the deterioration of conditions in the Chinese real estate market. Every year we examine whether or not it is reasonable to continue to hold cross-shareholdings, and we disposed of some of cross-shareholdings in FY2021.

Our property, plant and equipment, goodwill, and other assets are increasing every year as we continue to reinforce our manufacturing facilities and to aggressively execute M&A deals for future growth. At the same time, we have been taking measures to improve our asset efficiency and profitability, such as the transfer of the European automotive coatings business and the India businesses and the structural reform of the Japanese businesses and the marine coatings business. In addition, we are reducing the risk of impairment losses on goodwill by minimizing PMI risk through autonomous and decentralized management and building up excellent quality mergers and acquisitions.

As regards to the liability situation, we are prioritizing debt financing to secure the funds for growth by engaging in M&A and other investment activities. Accordingly, the net debt/EBITDA ratio, which indicates financial leverage, is expected to increase by about four times at the end of FY2022, from 3.4 times (after adjusting for one-off items) at the end of FY2021 before the completion of the Cromology acquisition. Basically, all our borrowings are in yen, with an average maturity of 5 years and an average before-tax interest rate of 0.4%, which means that they comprise an extremely stable debt composition. We will continue to procure finance at low interest rates and long-term maturities. We will also continue to pursue an optimal capital structure as well as to obtain highly positive evaluation and trust from lending financial institutions and rating agencies, in order to maintain sufficient leverage.

Based on our judgment that we need to reinforce our financial base to achieve further growth through M&A, we issued new shares through a third-party allotment in FY2021, thereby increasing capital. EPS accretion starting in the first year of acquisition is an important criterion for our judgment on M&A deals. Another key point is capital efficiency where we place emphasis on achieving ROIC that exceeds WACC.

The focus of our equity policy is to raise total shareholder return (TSR) through earnings per share (EPS) growth by prioritizing growth investments while maintaining financial discipline. As part of our effort to raise TSR, our policy is to maintain steady and consistent dividend payments with a target dividend payout ratio of 30% while taking full account of factors including the trend in earnings and investment opportunities available. In FY2021, we paid an annual dividend of ¥10 per share, including the special dividend of ¥1 per share to commemorate the 140th anniversary of the foundation of the company.Balance sheet management policy

As of the end of December 2021

- Assets

-

- Cash and equivalents ¥138.8bn

- Trade and other receivables ¥266.9bn

- Assets held for sale ¥3.9bn

- Property, plant and equipment ¥301.7bn

- Goodwill ¥652.7bn

- Other intangible assets ¥300.2bn

- Total ¥1,955.1bn

- Assets

-

“Cash and cash equivalents” and

“Trade and other receivables”- Review the cash conversion cycle (CCC) in response to reflect the impact of the pandemic and deterioration of the conditions in the Chinese real estate market (e.g., review trade terms and conditions)

- Take actions to respond to future credit collection risk (e.g., recording a provision for possible credit loss in China)

“Assets held for sale”

- Examine the rationality of continuing to hold cross-shareholdings every year (disposed of some cross-shareholdings in FY2021)

“Property, plant and equipment”

- Take actions to improve asset efficiency and profitability through business divestiture and structural reform (e.g., transfer of the European automotive coatings business and the India business and structural reform of the Japanese businesses and the marine business)

“Goodwill” and “Other intangible assets”

- Minimize PMI risk based on autonomous and decentralized management and reduce impairment losses by building up excellent quality mergers and acquisitions

- Liabilities

-

- Trade and other payables ¥209.7bn

- Bonds and loans payable ¥523.0bn

- Total ¥986.4bn

- Liabilities

-

“Bonds and loans payable”

(Interest-bearing debts)- Prioritize debt financing and maintain the leverage capacity (the expected net debt/EBITDA at the end of FY2022 is around 4x)

- Evaluation from credit agencies (maintained the “A” rating from R&I)

- Stable finance procurement capability in yen (low interest rate/long-term maturity)

- Equity

-

- Capital ¥671.4bn

- Retained earnings ¥228.0bn

- Total ¥968.7bn

- Equity

-

“Capital” and

“Retained earnings”- Reinforce financial base to prepare for growth investment such as M&A (capital increase based on new share issuance through a third-party allotment)

- Equity-based capital raising remaining an option with EPS accretion as a premise

- Include capital efficiency in the consideration of M&A decisions, including achieving ROIC that exceeds WACC

- Aim to maintain the dividend payout ratio at 30%

Pages related to Our Medium- and Long-Term Management Strategy

- Integrated Report 2022 (Digital Edition)