A shining beacon through chaotic times

Wee Siew Kim

Director, Representative Executive Officer & Co-President

PROFILE

Wee Siew Kim was appointed as the Representative Executive Officer & Co-President on April 28, 2021 and as a Director of Nippon Paint Holdings in March 2022. He is concurrently the Group Chief Executive Officer of NIPSEA Group, a wholly owned partner company of the Nippon Paint Group. Prior to his current position, he was Deputy CEO and President (Defense Business) of Singapore Technologies Engineering Ltd. He started his career with Singapore Technologies in 1984 as an engineer at Singapore Aircraft Industries Pte. Ltd., the predecessor company of Singapore Technologies Aerospace Ltd. He was educated at Raffles Institution, followed by the Imperial College of Science and Technology in London where he received a Bachelor of Science (Aeronautical Engineering)(Hons) degree. This was followed by an MBA at Stanford University. He was a Member of Parliament in Singapore from 2001 to 2011.

From pandemic to endemic: Transforming our business outlook

While the world has emerged from the pandemic, supply chain disruptions and the conflict between Ukraine and Russia have impacted businesses globally. Inflation is now at its worst in over four decades and a looming recession threatens business profitability.

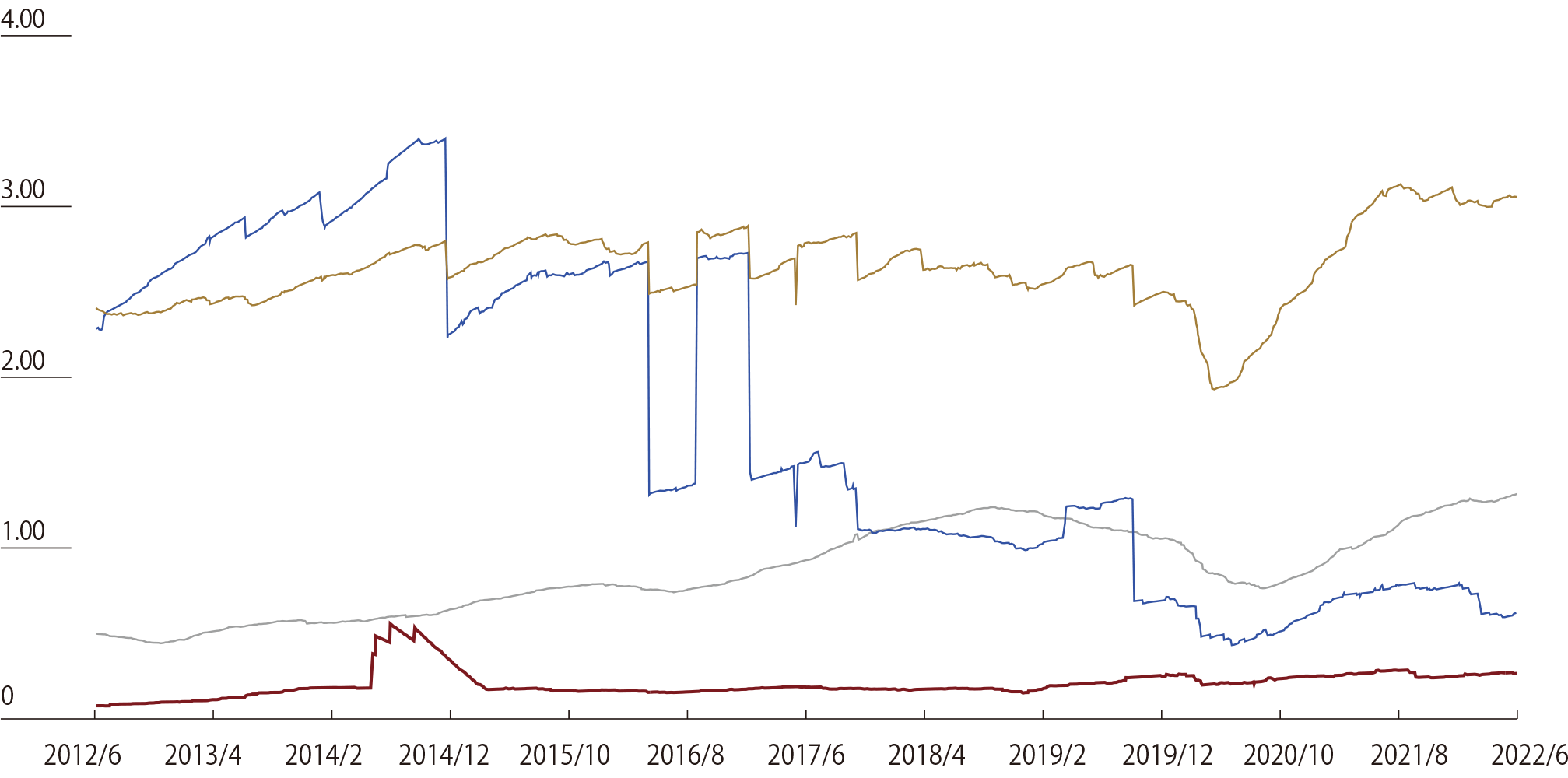

Despite this, the Group has continued to steadily sail through the year by maximizing earnings-per-share (EPS) through our firmly established Asset Assembler model. By remaining vigilant and steadfast, the company increased EPS by 7.4% in FY2021 to 29.41 yen and we are on track towards achieving our final year targets in the Medium-Term Plan (FY2021-2023). All-in-all, our EPS has increased by 239% over the past 10 years, which significantly outperforms the TOPIX chemical sector average and other competitors (See the bottom right chart).

In my first year as Co-President, the Group has achieved record revenue despite these challenges, and we have achieved the same level of operating profit as FY2021 by raising selling prices and reducing SG&A expenses to mitigate raw material price inflations.

One of our success factors is our ability to spot opportunities in adjacent industries and implement a hugely successful Asset Assembler strategy. Nippon Paint Group’s Asset Assembler model is unique in that it maintains the acquired company’s autonomy. We value the years of experience that the senior management in these existing teams have, as they were integral to growing the business in the markets that they operate in. We also looked at acquisitions focused on related industries with the aim of maximizing shareholder value by expanding our reach into new but still familiar territories.

The adjacency arena presents enormous opportunity and allows us to hedge our bets by diversifying our product range. We now have water-proofing materials, adhesives, floor coatings and fillers (SAF) amongst other product offerings.

Strengthening our portfolio into these complimentary products is a sound strategy that leverages our existing manufacturing, marketing, and distribution channels, which means maximizing our market potential.

This gives us an additional construction chemicals market potential of USD90 billion in addition to the paint and coatings segment, which is valued at around USD174 billion.

|

Historical EPS of NPHD  |

■Average of competitors (average value) $3.06 (+27%) ■The TOPIX chemical sector average $1.31 (+162%) ■Average of competitors (mean value) $0.62 (-73%) ■NPHD $0.27 (+239%) |

*1 Source: FactSet (as of June 30, 2022), Bloomberg

*2 Competitors cover Sherwin-Williams, BASF, Asian Paints, PPG Industries, AkzoNobel, Berger Paints, Axalta, SKSHU Paint, Kansai Paint, TOA Paint, Asia Cuanon

*3 EPS (for the next 12 months) was converted to USD at the following exchange rates as of June 30, 2022: USD/EUR=1.04545; USD/INR=0.012663; USD/CNY=0.149381; USD/JPY=0.07361, USD/THB=0.028285)

Setting sails to revitalize our marine coatings segment

While we have many areas to be proud of this year, there are segments of the business that need to be revitalized for us to reach our goals in the coming years. One of the key areas we will focus on is the marine coatings business. In FY2021, this segment recorded an operating loss of around 1.9 billion yen, primarily coming from Japan and Korea.

In general, the shipping industry has seen many peaks and troughs, which can present a volatile situation for all related businesses. Having said this, we believe that we have a good strategy in place to facilitate a turnaround in the key markets where the marine coatings sector has the highest potential.

To start, we restructured the operations team, separating the Japanese management from the other markets as we noted the difference between local and international expertise and culture.

We then reviewed the Japanese operations and merged the industrial and marine coatings businesses placing them under the leadership of Takeshi Shiotani, who will now serve concurrently as the President of Nippon Paint Industrial Coatings (NPIU) and Nippon Paint Marine Coatings (NPMC).

Mr. Shiotani has a proven track record and we are confident that his leadership and ability will bring a positive transformation to the NPMC business. In his expanded capacity, he will ensure the implementation of best practices for cost management and sales distribution are aligned with the industrial coatings business with a laser focus on improving the business financials.

Apart from Japan, we also made changes to the Korean operations, revamping the management team, business and sales models to areas that are more profitable and provide financial stability.

This meant shifting our balance in Korea from new ship building deals to more maintenance and repairs where the financial prospects are better. The changes made are already bearing fruit and we are expecting the Korea business to return to an operating profit in FY2023.

To further strengthen the global marine coatings business ecosystem, we broadened our supply chain and marketing activities, shifting away from a narrow, country-focused mindset to one that maintains a flexible approach. This new global-perspective allowed us to further push out our advanced product technologies like AQUATERRAS, FASTAR, A-LF-Sea, NEOGUARD and NOA to deliver superior performance, earning us good testimony and trust from new and regular clients alike.

With a stronger marketing push to encourage market adoption via our global supply chain, we expect a strong take-up in other partner companies’ markets. This is starting to be evident in NIPSEA Group markets such as Indonesia, Vietnam, the Philippines and India.

We believe that by continuing to implement the above strategies, the marine coatings business will improve and change for the better.

Building customer trust with collaborations and consolidations

There have been many views regarding our exposure to the real estate sector in China, especially with current economic and geopolitical conditions prompting many to be skeptical about its growth prospects.

Notwithstanding this, NIPSEA Group continues to be resilient and flexible while sticking to our mission to ensure growth and maximum shareholder value. In China, our strong performance is a testament to our ability to thrive in a highly competitive market.

We continue to have strong market share in this region and see the potential for GDP+alpha growth contributed mainly by the decorative paints market and dominant market share in mainly Tier 1 and 2 cities. Even as off-and-on lockdowns persisted, the renovation and DIY sector continued to eke out growth as consumers worked on refreshing their surroundings.

Specifically in the DIY sector, the country saw an increase in demand through new products including the eco-friendly Kid’s Paint and Eco-essence paint, indicating a need for paints that are beneficial for the environment and are also asthma and allergy friendly.

We also see encouraging prospects in the Tier 3 and 4 cities, where our teams have already commenced a detailed market analysis of trends to determine the correct approach and business strategies for implementation. We are leaving no stone unturned to ensure that we have the right strategies in place to meet the needs of clients and consumers in these different cities as living conditions can vary from city to city.

Having said this, we are aware of the public sentiment on the Chinese real estate market and remain vigilant of any developments. The key here is that we have a highly adaptable team, ready to shift according to consumer sentiments to ensure continued business sustainability in this segment. As the market requirement changes, we can flexibly deliver differentiated offerings to our business clients in China through collaborations with strategic construction vendors and project service vendors. With our scale and reach, we offer to the market the convenience of having a one-stop solution provider in which we endeavor to meet customers’ paint and coatings needs.

Aside from the above, our research and studies reveal that there will be continued demand for houses, driven by the population concentration in urban areas and the further upturn in economic activities as urbanization progresses in different parts of China.

As such, we view downturns to be temporary and are confident of the medium to long-term growth potential for the Chinese market.

New economic power houses

Being a global company means we can capture the potential and act on opportunities worldwide. In this respect, we see growth prospects around the world. For example, in Indonesia our continued marketing push and expanding distribution network have produced promising results.

The market is valued at around USD 2 billion and has grown at 17-18% annual rate. Under the current government and new policies put in place, we see more potential in the future having achieved a growth of 5.02% in GDP in 2021.

There are also several large projects that have been launched in the country including the recent announcement of Nusantara, Indonesia’s new green and smart capital in Kalimantan that will be developed in stages through to 2045.

Prudent price management in times of recession and inflation cycles in Indonesia also helped to maintain sound financials in this region. This, coupled with a healthy market environment, means that Indonesia remains as one of our more profitable markets.

For continued success, the team will invest in advertising to drive brand top-of-mind recall and preference. We will also ensure a wider distribution of Computerized Colour Matching (CCM) machines and increase product penetration in all product segments in our CCM stores.

Another expansion tactic is to capitalize on the trend of digital transformation and a shift towards more technology-driven sales channels. Technology and data tracking have helped us determine a strong demand for online e-commerce sales channels, especially in Indonesia, where it can be challenging to navigate the country’s main islands and smaller cities.

For this, we will be establishing new channels to enable more online purchasing and inquiries. We plan to open more depots or stock points and strengthen our sales team to further widen our geographical coverage in the country. This will help support both our customers and other sales or dealer distribution channels more effectively.

Likewise, as it is with our other global markets, we will also expand product offerings.

We see huge potential for us to market our other popular products in Indonesia, especially in the non-paint segment. We are highly confident that Indonesia will continue to perform strongly.

Business acceleration through adjacencies

While times are uncertain and there remains to be an abundance of challenges that all businesses will face, we are confident that our continued execution of the unique Asset Assembler model will bring positive results in the coming year.

There is strength in numbers and we are definitely benefiting from the various acquisitions and mergers that have been completed over the last few years. For instance, our non-paint business in Malaysia was expanded through the introduction of Selleys and the acquisition of Vital Technical and Construction Material Industry Sdn Bhd.

The Selleys SAF premium brand gave us an avenue to increase our innovative offerings to a new group of customers including key retail partners.

Beyond Malaysia, these acquisitions provided a new range of products to the NIPSEA Group market helping close deals that required quality yet budget-conscious options as well.

These successes would not have been possible without the retention of expertise from the DuluxGroup and Betek Boya groups that have been introduced to the NIPSEA Group team.

We also completed the acquisitions of Cromology and JUB, which not only led to further expansion of our decorative paints segment but also expanded our distribution network exponentially in the European region. Looking to the future, we will continue to look out for more adjacent and complimentary businesses. This is a key engine of growth and can work to accelerate our group’s financial successes in the future.

Moving forward with an autonomous partnership agenda

Through deft execution of Asset Assembler model, we aim to achieve our mission of Maximization of Shareholder Value. However, we will maintain that this model can only work if we continue to inspire autonomous business execution and growth among partner companies while providing a framework that leverages every partner company’s strength.

Having an autonomous and decentralized management will take us to greater heights as each partner company fully benefits from this Nippon Paint Group business model.

After all, only through embracing diversity and encouraging everyone to do so can we leverage the benefits of team work and realize employee potential. Hence, we are constantly advocating for our teams to share positive examples, benefits, success cases and more with each other in the spirit of learning and improving.

As we come full circle, it gives me great pride to share that despite the unpredictable happenings through the past year, we have managed to achieve our medium-term plan revenue a year in advance while maintaining our 2023 operating profit target and will continue to remain focused on achieving our business objectives through revenue growth and margin improvement.

August 31, 2022

Director, Representative Executive Officer & Co-President

- Integrated Report 2022 (Digital Edition)