Pursuing maximization of PER by executing a management strategy based on Asset Assembler model

Yuichiro Wakatsuki

Director, Representative Executive Officer & Co-President

PROFILE

Yuichiro Wakatsuki began his career at The Industrial Bank of Japan, Limited (currently Mizuho Bank, Ltd.) and Schroders Japan Limited, and in 2000 joined Merrill Lynch Japan Securities Co., Ltd. (currently BofA Securities Japan Co., Ltd.). For a number of years, he led the company’s M&A advisory services, including M&A strategy and fund procurement of clients, as the Head of Japan Mergers and Acquisitions, Head of Japan Investment Banking, Director, and Vice Chairman. In 2019, he joined Nippon Paint Holdings and in 2020 was appointed Senior Managing Corporate Officer and CFO, overseeing corporate planning, finance & accounting, public relations, investor relations, and M&A. He was appointed Representative Executive Officer & Co-President of Nippon Paint Holdings on April 28, 2021 and Director, Representative Executive Officer & Co-President in March 2022.

Focusing on maximization of PER through appropriate allocation of limited resources

Securing more control over my time allocation—this is one of the biggest changes I have earned since I became Co-President. I deliberately abandoned unnecessary meetings and inefficient tasks. This allowed me to create an environment to focus more of my time and energy for PER maximization which is my primary mission.

While feeling the pressure of delivering MSV, which is reflected in the stock price every day, I was able to execute numerous corporate actions without delay for the future growth of EPS and PER. Major actions include transfer of European automotive coatings business and India businesses to Wuthelam Group, acquisitions of Cromology and JUB in Europe, company split into Nippon Paint Holdings (NPHD), the holding company, and Nippon Paint Corporate Solutions (NPCS), a Japan focused functional company, and international secondary offering of shares.

Following our appointment as Co-Presidents, concerns towards Co-President setup slowing down our decision making came to my attention. I believe the outcome was to the contrary and close communication with my partner Wee Siew Kim with MSV as a common basis for judgement has further upgraded and accelerated our decision making.

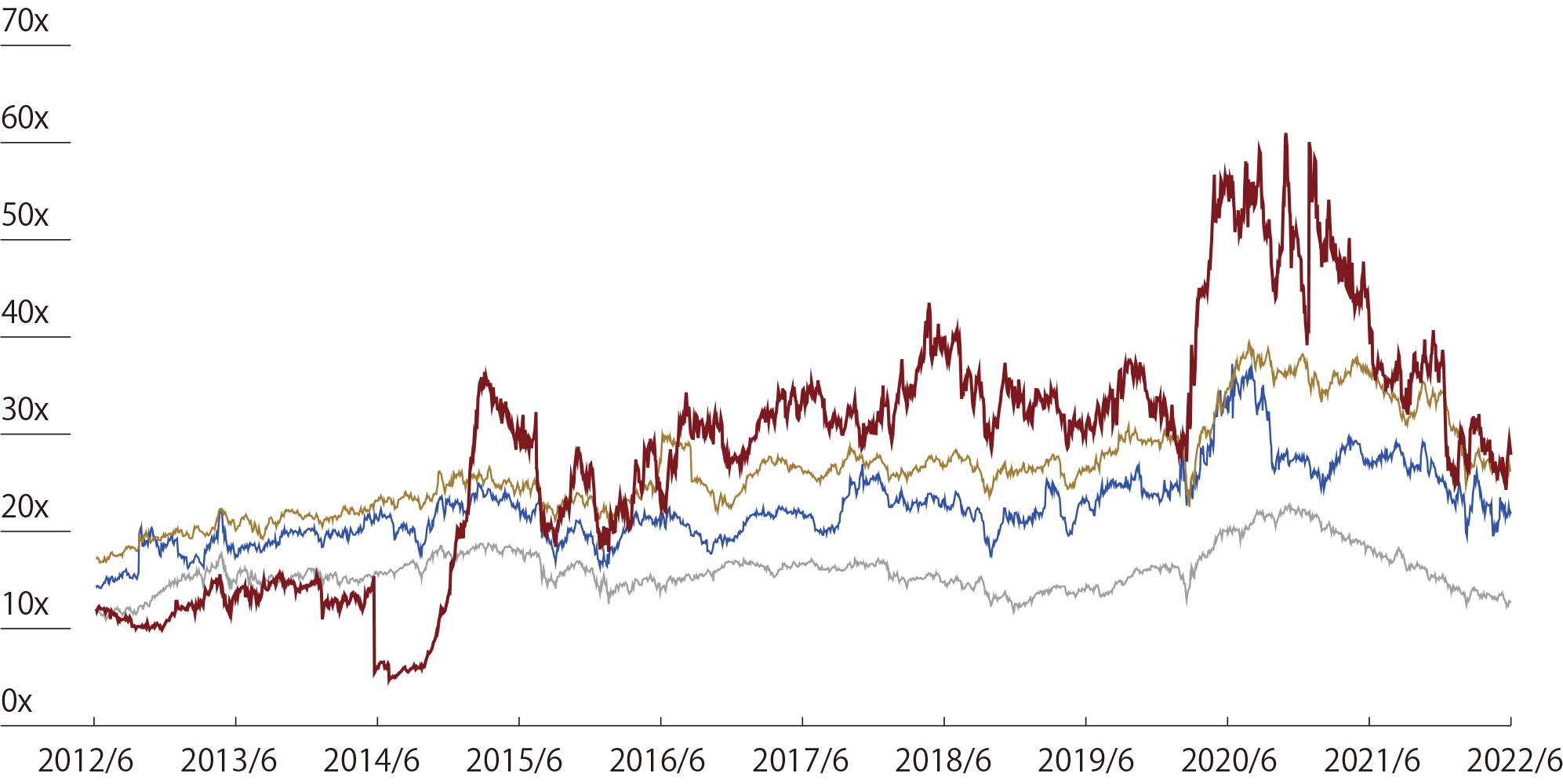

PER basically reflects expectations from capital markets, and in that sense is a reflection of a company’s growth potential. Our FY2021-end PER (for the next 12 months) was 37x (see the chart below). In fact, our PER has outperformed the TOPIX chemical sector average and the average of competitors over the past 10 years. I believe this reflects on the high expectations for our growth potential, many of which we have delivered, among investors. I will continue to take actions, including but not limited to, proactive capital markets communications, executing optimal financial strategy, and sustainability initiatives, in order to respond and exceed these expectations. Further, I will continue to constantly build on our track record of excellent M&A deals that contribute to our future growth with the goal of maximizing our PER.

In January 2022, we initiated an international secondary share offering with the aim to improve liquidity of our stock and eliminate potential risk of a stock overhang. The offering helped us build a global base of investors who recognize the value of our growth strategy from a long-term perspective. Unfortunately, our stock price declined temporarily through the process despite no issuance of new shares/no dilution. However, I believe this secondary offering was a necessary step for our medium- and long-term growth.

Assembling excellent talent and brands through M&A, building on organic growth

Following our appointment as Co-Presidents, I, with Wee Siew Kim and the board members, have held extensive discussions about the ideal business model. We raised emphasis on the autonomy and accountability at every partner company while maintaining a small headquarters. Our goal is to achieve strong growth with limited risk by building up M&A deals in the attractive market of paint and adjacencies. This is no change to our existing strategy but rather a crystallization of our business model in pursuit of our sole mission of MSV. We decided to call it Asset Assembler model.

The paint and adjacencies markets are very localized with different features in each markets, while also having an attractive risk-return profile. In consideration of such features, we believe delegating more authority to the partner company management who are well versed in the local markets and making agile decisions shall contribute more to MSV, rather than having the holding company direct and control partner companies worldwide in a centralized manner.

Under such model, every partner company fully exploits Nippon Paint Group’s worldwide resources, such as technical capabilities, powerful distribution network, purchasing power, and financing capabilities, while raising their motivation to use their own initiatives for accelerated growth. This concept is unique and different from the typical Western global standardization and cost reduction models.

We believe our successful acquisitions of DuluxGroup and Betek Boya could increase the likelihood of other excellent companies attracted to join our Group, enabling us to further build up talent and brands through M&A. While we will naturally require every partner company to be accountable and deliver the results, which is expected anyway be it a listed or private company, our partner companies under our umbrella can enjoy benefits that bring out their strengths and potential to the fullest, such as receiving financial support and reinforcing governance from a much longer perspective.

The stronger a company’s brand and market share are, the greater upside that company can aim under our Asset Assembler model. As an extension of building up assets by taking this approach, we aim to achieve MSV over the medium and long term.

|

Historical PER of NPHD  |

■NPHD 27.9x (+15.9x) ■Average of competitors (average value) 26.1x (+9.0x) ■Average of competitors (mean value) 21.8x (+7.4x) ■The TOPIX chemical sector average 12.6x (+1.0x) |

*1 Source: FactSet (as of June 30, 2022), Bloomberg

*2 PER (for the next 12 months) is calculated by the stock price on each day divided by EPS (for the next 12 months) on each day

*3 Competitors covered are Sherwin-Williams, BASF, Asian Paints, PPG Industries, AkzoNobel, Berger Paints India, Axalta, SKSHU Paint, Kansai Paint, TOA Paint, and Asia Cuanon

Management teams with Integrity based on Trust

In January 2022, Nippon Paint Group completed a corporate split in which functional units in Japan were spun off from the holding company (NPHD) into the newly established NPCS. The aim of this split was to separate functions as a listed company and functions related to the Japan segment, which were both previously performed by NPHD. This is one of the corporate actions we have taken based on Asset Assembler model. As a result, NPHD’s activities as a holding company are concentrated on functions such as evaluating the performance of partner companies, determining succession plans, M&A, finance and accounting, and investor relations. The newly launched NPCS will perform functions necessary for supporting and conducting business activities in Japan.

NPCS operates at the same level as partner companies in Japan and does not intend to “control” the Japan operations. Establishing a supervisory company has the risk of creating another bureaucracy which keeps expanding on its own. For this reason, as Co-President of NPHD, I serve concurrently as the President of NPCS and will manage the allocation of costs and expenses at NPCS from the total optimization perspective. Group operations overseas will be managed based on three segments: NIPSEA Group, DuluxGroup, and U.S. Budget management is basically implemented by the core company of each segment. The holding company will perform the functions of checking and monitoring the operations of each partner company.

As described above, Asset Assembler model respects the autonomy of every partner company and is based on autonomous governance by respective Executive Committees and the Boards. Wee Siew Kim and I concurrently serve as Directors of the core companies, which raises the effectiveness of governance of those companies. Our “Trust” towards every partner company underpins Asset Assembler model. Trust is not what is given but is something that one must earn by fulfilling his/her accountability and results delivery.

As a corporate executive, I place great importance on Integrity. Not that I force Integrity upon each and every management of partner companies. However, I cannot fully trust corporate managers who do not have Integrity. In that sense, Nippon Paint Group has continued to grow autonomously based on Trust. Simply put, we are a Corporate Group with Integrity.

Going beyond paint and coatings and into adjacencies (Paint++)

By executing our medium- and long-term management strategy using Asset Assembler model, Nippon Paint will aggressively expand the sphere of business activities from the paint and coatings area to the adjacencies area (Paint++). We will continue our aggressive M&A strategy, aiming to build up assets not only in our existing business areas but also in new areas with the goal of achieving MSV.

Some have pointed out that we will acquire all the attractive targets within the next couple of years if we keep executing M&A deals at this pace. However, the aggregate market share of the world’s 10 largest paint manufacturers, including Nippon Paint, is less than 50%. As a result, there are still significant opportunities for business expansion through M&A in the fragmented markets. Further, if we include the adjacencies market which is around three times larger than the paint and coatings market, our growth opportunities through M&A are even greater.

Of course, we will not execute M&A deals that do not contribute to MSV. We will not pursue companies with valuations that are too high, companies with a risk-return profile that is not attractive or simply the magnitude is too large, and companies in areas where we do not have market know-how. Acquiring these types of companies could make our Group larger but also impair shareholder value and we examine every M&A opportunity with vigilance. However, there is significant opportunity to venture into new areas based on attractive businesses owned by our partner companies.

For instance, the Selleys brand of adhesives owned by DuluxGroup is now well established in the Western and Asian markets. However, we had not known about this area before the acquisition of DuluxGroup. After joining our Group, DuluxGroup agreed with NIPSEA Group to deploy Selleys brand in Asia through the NIPSEA Group distribution channel which has successfully advanced to a growth trajectory. In this manner, it is quite possible that our business areas will expand in a snowball-like manner through M&A.

Some capital market participants view Nippon Paint as a China-related stock. However, I’m convinced that we can evolve to become a corporate group with a unique and strong presence in every region and market around the world within 10 years with our growth accelerating over the medium and long term based on Asset Assembler model. Asset Assembler model should work for the pursuit of MSV. The ultimate goal of our medium- and long-term growth strategy is the relentless pursuit of MSV. And there are immense possibilities ahead of us.

Unified by MSV for achieving growth in the medium and long term

We launched a new management structure in FY2022 for sustainability based on Asset Assembler model. In the new structure, we have four Global Teams (Environment & Safety, People & Community, Innovation & Product Stewardship, and Governance), that directly report to Co-Presidents, based on material issues for sustainability (Materiality) identified from a global perspective.

Global Team Leaders are experts selected from our partner companies globally. They will lead sustainability initiatives required by laws and regulations and social customs in each region and market. The Global Team Leaders directly report strategies and progress to Co-Presidents, who will report to the Board of Directors as necessary. As a result, our sustainability initiatives are supervised by the Board of Directors. Sustainability initiatives are not only essential to earn the Trust of investors but will also contribute to EPS and PER by encouraging autonomous activities of each partner company and reinforcing the link with our businesses.

On the governance front, we are taking actions to continuously strengthen governance in order to gain the Trust of investors involved with our business activities. Taking into account our shareholder composition where our major shareholder, Wuthelam Group, holds 58.7% of our stock, we nominated the Lead Independent Director as the Board Chair to coincide with the launch of the Co-President setup. In addition, the Board of Directors now has eight Independent Directors out of 11 board members. In this manner, we are taking actions to ensure the protection of the interests of minority shareholders.

Wuthelam Group is our important partner that has built a deep bond with us over 60 years. More than anything, we share the common mission of MSV with Wuthelam. I believe that having our major shareholder and the Directors and Executive Officers united across the board by MSV means a great deal for achieving growth in the medium and long term.

Accomplishing our transformation based on a clear mission and Trust

As repeated many times, Nippon Paint Group is pursuing MSV as its sole mission. We have already put in place advanced and effective governance, Asset Assembler model, and medium- and long-term management strategies for achieving MSV.

At the same time, I believe we need to constantly evolve as a Lean and Agile Corporate Group that can grow steadily in any environment in order to continue to make investments and achieve growth over the medium and long term. I’m confident that with all the excellent and trustworthy partner companies, we will enable our transformation. In Japan, we will stimulate changes in the mindset of all employees and create a new corporate culture without being restricted by our conventional procedures as we continue to be driven by our insatiable appetite for growth.

Let us continue to strive for MSV by delivering clear outcomes to investors. We are driven to exceed your expectations.

August 31, 2022

Director, Representative Executive Officer & Co-President

- Integrated Report 2022 (Digital Edition)