Medium-Term Strategy Update (2025)

Released April 3, 2025

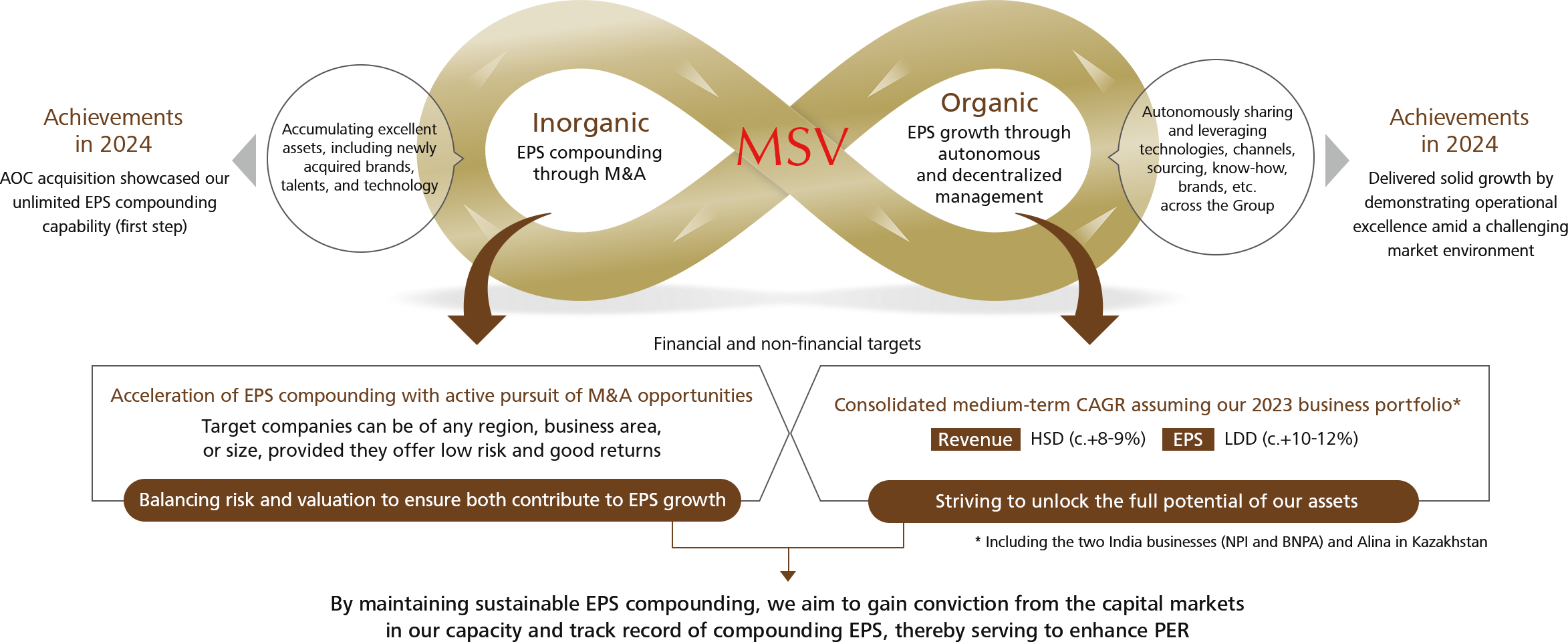

The enduring strength of our Asset Assembler model enables MSV in the long term

The acquisition of AOC—announced in October 2024 and completed in March 2025—in accordance with the Medium-Term Strategy unveiled in April 2024, demonstrated our unlimited EPS compounding capability under the Asset Assembler model. Even amid a business environment that proved more challenging than anticipated, our organic businesses have demonstrated solid performance, driving steady growth through operational excellence. We are confident that, across all regions and business segments, our Group is well positioned to achieve the medium-term growth forecasts.

We remain committed to low-risk and stable EPS compounding, driven by both organic and inorganic initiatives. By consistently demonstrating our ability to deliver and sustain EPS compounding, we aim to earn strong conviction from the capital markets to enhance PER and achieve MSV over the long term.

Key Points of the Medium-Term Strategy Update

-

No change to our strategy of pursuing low-risk and stable EPS compounding through both organic and inorganic initiatives

- Organic: Targeting medium-term consolidated revenue CAGR of 8-9% and EPS CAGR of 10-12%, based on the 2023 portfolio

- Inorganic: Further accelerate EPS compounding by pursuing M&A that compounds EPS safely and sustainably

- Aim to increase our PER by earning the conviction of the capital markets in our EPS growth capability and track record

How We Leverage Asset Assembler Model to Achieve MSV

Our financial and non-financial targets as Asset Assembler

| Inorganic Growth EPS compounding through M&A |

Further accelerating EPS compounding with active pursuit of M&A opportunities

|

|---|---|

| Organic Growth EPS growth through autonomous and decentralized management |

Consolidated medium-term CAGR assuming our 2023 business portfolio*

|

* 2023 portfolio including the two India businesses (NPI and BNPA) and Alina (Kazakhstan)

Achievements in 2024

| Inorganic Growth EPS compounding through M&A |

AOC acquisition showcased our unlimited EPS compounding capability (first step) |

|---|---|

| Organic Growth EPS growth through autonomous and decentralized management |

Delivered solid growth by demonstrating operational excellence amid a challenging market environment |

EPS compounding through inorganic growth initiatives

AOC’s acquisition embodies our Asset Assembler strategy

The consolidation of AOC, following the completion of its acquisition in March 2025, is expected to contribute significantly to EPS growth from the first year. This exemplifies our approach to M&A, where we capitalize on the advantage of a lean headquarters to pursue opportunities in any region, business domain, or scale, provided they present low risk and offer good returns, thereby enabling unlimited EPS compounding. Moving forward, we will continue to carefully balance risk and returns as we strive for safe and sustainable EPS compounding.

AOC’s acquisition

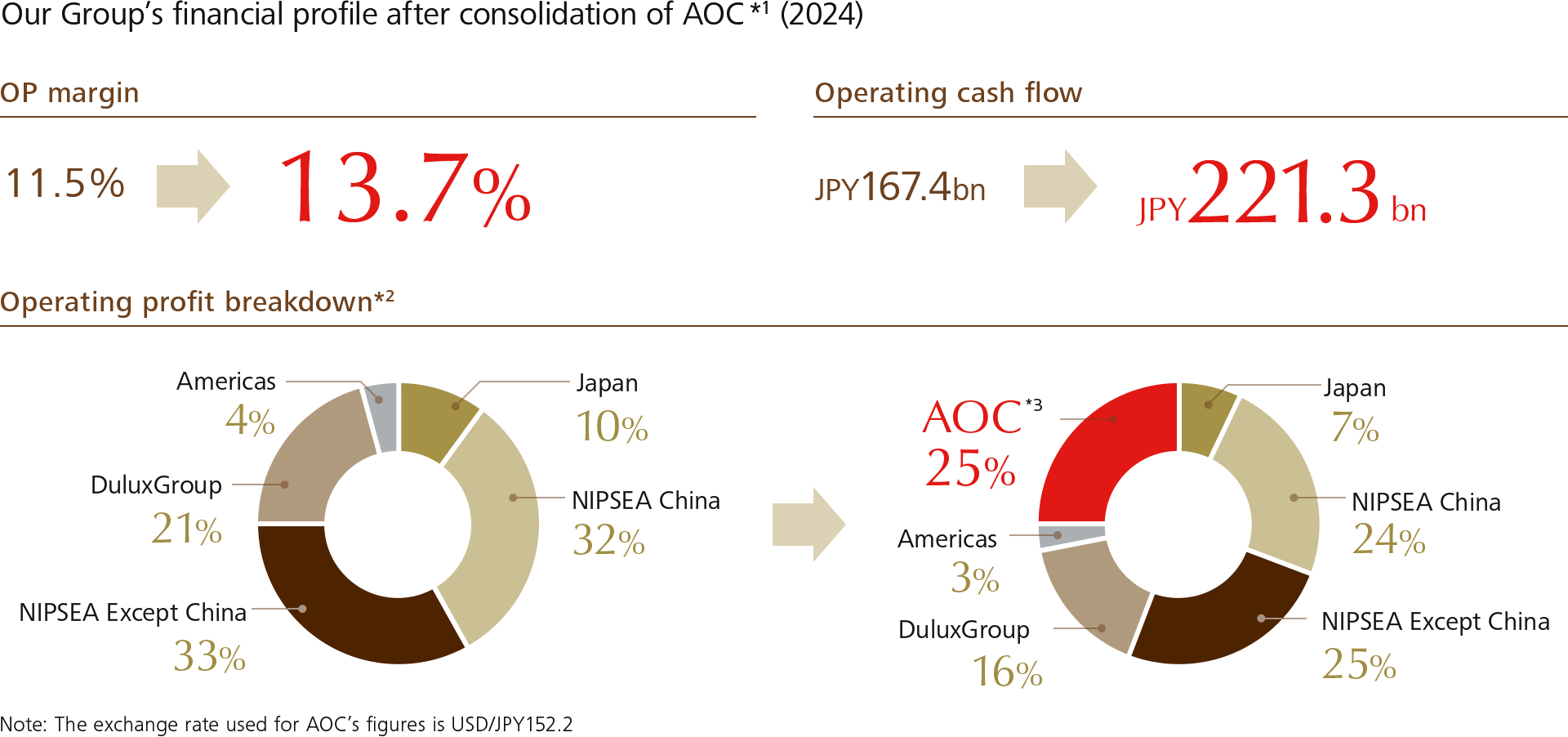

The addition of a new growth pillar following NIPSEA, DuluxGroup, etc. has transformed our margin profile, cash flow, and business composition.

*1 FY2024 results are proforma, representative as if AOC operated as subsidiary for the whole of 2024

*2 Percentages to the total sum of segment profit

*3 PPA reflects our current assumptions but excludes one-off costs such as inventory step-up. M&A expenses related to the AOC acquisition are excluded. To align with our post-acquisition profit and loss profile, expenses such as payments to India businesses in EMEA and affiliated companies of former shareholders are also excluded

EPS compounding through organic growth initiatives

Delivering robust growth through operational excellence amid a challenging market environment

Although the market environment in 2024 was more challenging than anticipated, our Group achieved solid growth by leveraging the strong brand power and technological capabilities of each asset through effective marketing and pricing strategies. Our Group has continued to achieve resilient growth by capitalizing on the advantage of autonomous and decentralized management. Looking ahead, we remain committed to compounding EPS by delivering market+α growth.

Growth forecast by asset

| 2024 results | Medium-term forecast (in LCY) | Market growth forecast*2 | |||||

|---|---|---|---|---|---|---|---|

| Revenue (YoY) (in LCY) |

OP margin (Tanshin) |

Revenue CAGR | OP margin (vs 2023)*1 |

Volume basis | Value basis | ||

| Japan | +0.1% | 9.6% | +0–5% |  |

-1% (Decorative) | +1% (Decorative) | |

| NIPSEA China | Segment total | +6.3% | 11.1% | c. +10% | → | ||

| Decorative (TUC) | +6% | +10–15% | +3% | +1% | |||

| Decorative (TUB) | -15% | c. +5% | +1% | +2% | |||

| NIPSEA Except China |

Segment total | +13.1%*3 | 17.2% | +5–10% | → | ||

| Singapore Grp. Malaysia Grp. Thailand Grp. |

+5–10% | → |

Singapore +1% Malaysia +3% Thailand +2% |

Singapore +1% Malaysia +5% Thailand +2% |

|||

| PT Nipsea (Indonesia) | +3.4% | 34.9% | c. +10% | → | +3% | +6% | |

| Betek Boya (Türkiye) | +34.9% | 13.2% | c. +10% | (→)*4 | +1% | +7% | |

| NPI/BNPA (India) | (For reference) +0.8%*5 |

(For reference) 4.2%*5 |

c. +10% | → | +5% (Decorative) | -2% (Decorative) | |

| Alina (Kazakhstan) | (For reference) +8.1%*6 |

13.2%*7 | c. +10% | → | +3% | +4% | |

| DuluxGroup | DGL (Pacific) | +4.5% | 13.3% | c. +5% | → | –+1% | +2–2.5% |

| DGL (Europe) | -2.3%*8 | 4.9% | +5–10% | ↑ | –+1% (France) | +1–3% (France) | |

| Dunn-Edwards | +4.8% | c. +5% | ↑ | +2% (overall U.S.) | +5% (overall U.S.) | ||

| AOC*9 | (For reference) -8.9% |

(For reference) 30.7% |

c. +5% | → | +3% (U.S.) +3% (Europe) |

+5% (U.S.) +5% (Europe) |

|

*1 ↑: ≧+2%, ↗: +1%–+2%, →: -1%–+1%, ↘: -1%–-2%, ↓: ≦-2%

*2 Internal estimates and value basis include the impact of volume changes

*3 Excluding India businesses (NPI/BNPA) and Alina

*4 Subject to change due to the impact of hyperinflationary accounting

*5 Pro-forma figures (unaudited). The 2024 results are annualized figures

*6 The 2023 results are Pro-forma figures (unaudited)

*7 Including inventory step-up costs (one-off expenses) associated with PPA

*8 Excluding six-month earnings of NPT

*9 FY2024 results are pro-forma figures (unaudited). PPA reflects our current assumptions but excludes one-off costs such as inventory step-up. M&A expenses related to the AOC acquisition are excluded. To align with our post-acquisition profit and loss profile, expenses such as payments to India businesses in EMEA and affiliated companies of former shareholders are also excluded

For details on the market growth forecast and medium-term strategy by asset, please refer to pages 8 and 9, as well as the Appendix, of the Mdium-Term Strategy Update Briefing presentation material.

Finance Strategy Update

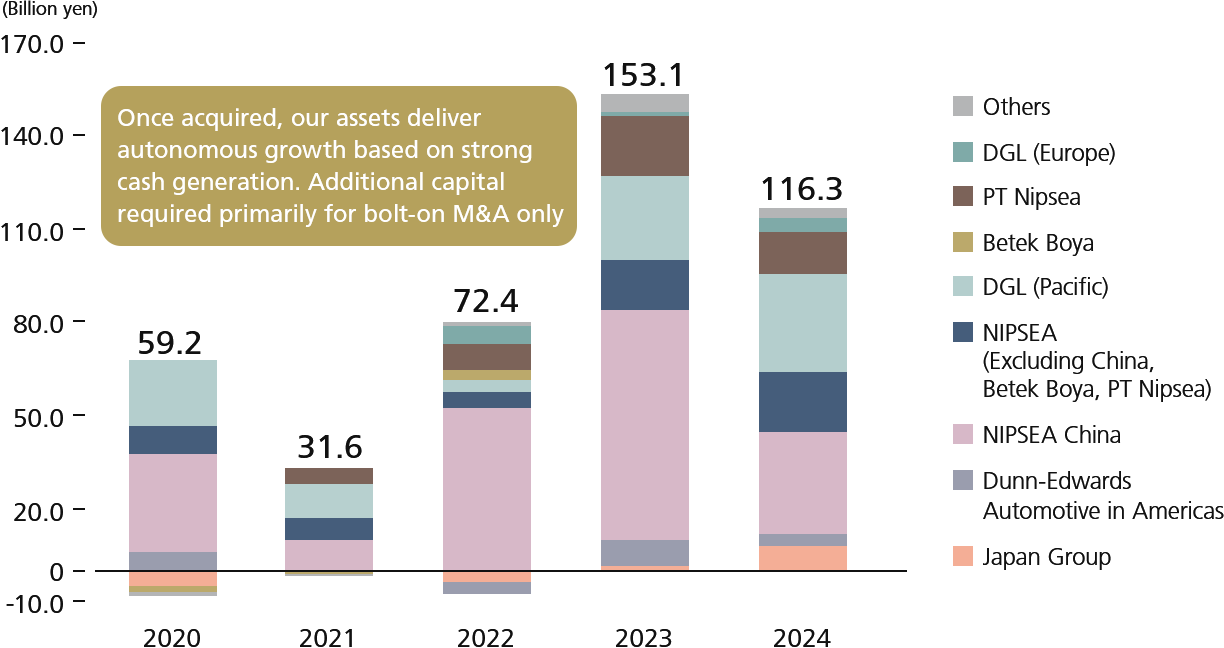

Cash flow* generation trends

In 2023, we generated exceptionally strong cash flow, mainly driven by strengthened receivables collection at NIPSEA China. Although cash flow decreased slightly in 2024 from the previous year, our ability to generate cash femained robust.

* Calculated as a simple sum of Operating CF (excluding dividend income from Group subsidiaries) – Capex (excluding M&A and lease costs)

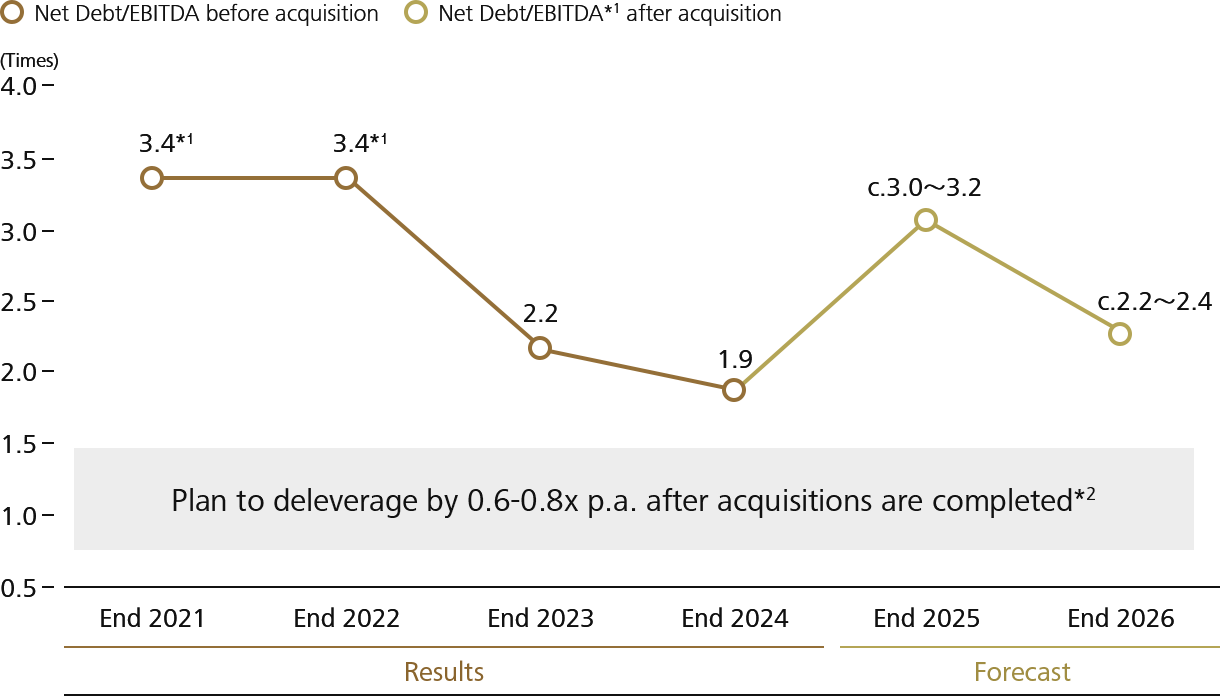

Leverage level

As a result, our Net Debt/EBITDA fell below 2.0x at the end of 2024. Even after factoring in the AOC acquisition, the ratio is projected to be just over 3.0x at the end of 2025, which remains well within a safe range. Furthermore, given AOC’s strong cash generation, our Net Debt/EBITDA is expected to decrease to slightly above 2.0x again by the end of 2026. This provides us with ample capacity to continue pursuing M&A opportuniites.

*1 Excluding one-off items

*2 Assuming no additional acquisitions

Our approach to PER maximization

Share our growth vision with capital markets based on our track of sustainable EPS compounding and conviction in management vision

(1) Nippon Paint as EPS Compounding Machine

- Achieved EPS growth for five consecutive years despite challenges such as COVID-19 and elevated crude oil prices

- Sustaining an outstanding track record in M&A

(2) Enhance market conviction towards our management vision

- Notion of Nippon Paint, with MSV as sole mission, being fully committed to delivering both organic and inorganic growth

(3) Alignment of growth vision with market (limited risk + infinite growth)

- Our base businesses are resilient, making sustainable growth fully attainable

- Continued accumulation of safe M&A with clear contribution to EPS compounding

- In addition to bolt-on M&A, we continue to pursue acquisition of good assets like AOC, driving infinite growth

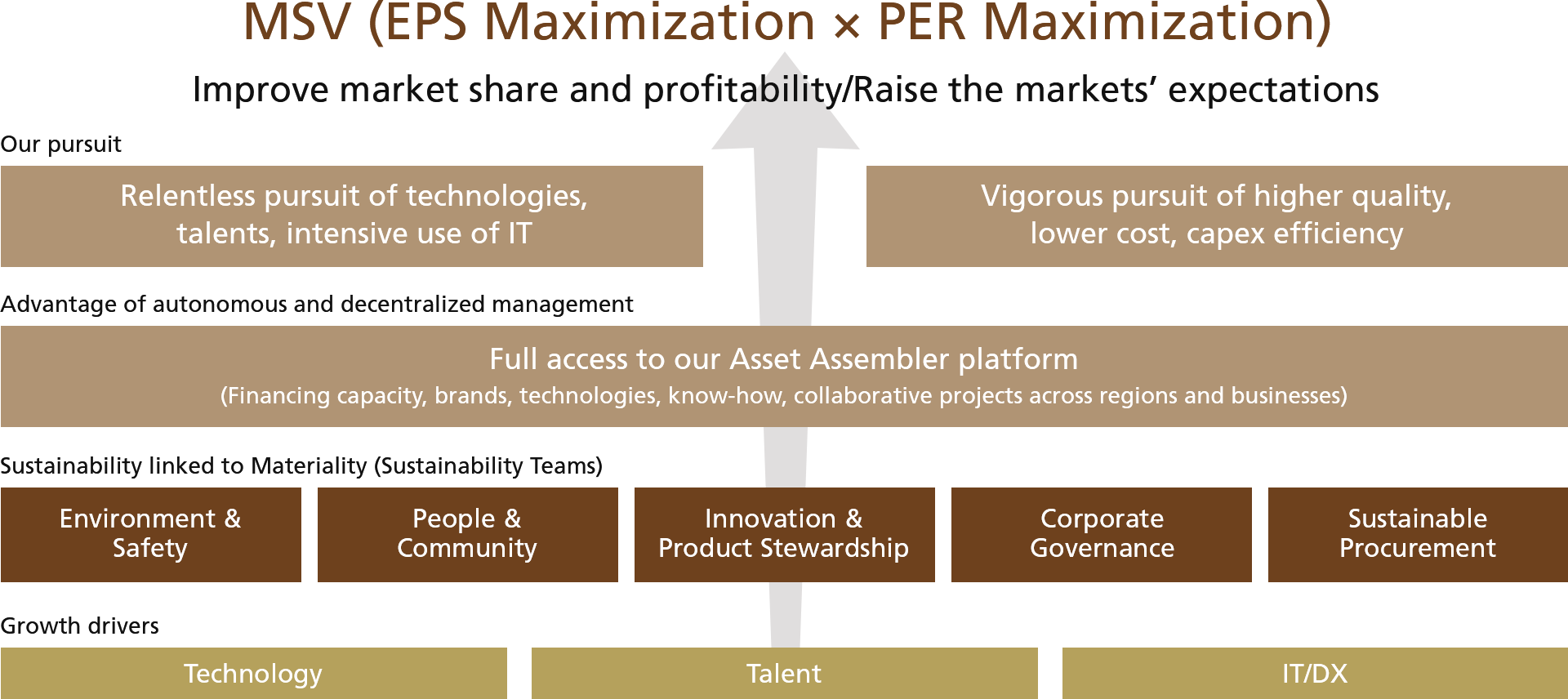

Sustainability initiatives that drive EPS and PER

We aim to achieve MSV by increasing the earnings and capital markets’ expectations via sustainability activities.

Our sole mission of MSV is premised on the fulfillment of our obligations to stakeholders, encompassing legal, social, and ethical duties. We view sustainability initiatives as integral to MSV, rather than viewing sustainability as an end in itself. Following this philosophy, the heads of our five sustainability teams have been selected from among the leaders of our partner companies. Utilizing our Asset Assembler platform, we aim to achieve MSV by engaging in cross-organizational efforts that not only develop technologies and nurture talent but also address our environmental and human rights obligations.

Medium-Term Strategy Update Materials