Continue our pursuit of Maximization of Shareholder Value (MSV) as an Asset Assembler through autonomouos and decentralized management based on Trust

It has been over a year since we became Co-Presidents. Since our appointment, we have pursued our sole mission of MSV by leveraging our partnerships based on strong Trust and guided by Purpose of Nippon Paint Group, “Enriching our living world through the power of Science + Imagination.” Wee Siew Kim focuses mainly on maximization of EPS (earnings per share) through revenue growth and earnings expansion. Yuichiro Wakatsuki concentrates on PER (price-to-earnings ratio) maximization by properly raising expectations of capital markets. Working closely together, we have taken numerous corporate actions without delay throughout the period.

As a result, revenue in FY2021, first year of our Medium-Term Plan (FY2021-2023, “MTP”), reached a record high despite the pandemic. Growth was attributable to higher sales volumes and a price/mix improvement, coupled with positive effect of exchange rate movements and consolidation of the Indonesia business. We expect to achieve revenue exceeding the final year revenue target of 1,100 billion yen in FY2022, the second year of MTP. Operating profit in FY2021 was not at a satisfactory level. However, there was meaningful profit improvement excluding one-off items with significant reduction in expenses compared to the initial budget while transitioning to a smaller headquarters at the holding company. Taking into consideration the quantitative and qualitative progress during the first year of MTP, we remain committed to the operating profit target of 140 billion yen in the final year. Nippon Paint will make a groupwide effort for achieving our targets through revenue growth and improvement in margins.

Our achievements in the first year of MTP also reaffirmed the strengths of our Asset Assembler model for accelerated growth through both existing businesses and M&A. Nippon Paint Group is pursuing autonomous growth through collaboration and cooperation among Group partner companies in each region based on autonomous and decentralized management. This management structure is underpinned by the delegation of authority and accountability based on Trust with our partner companies around the world. Every day we appreciate the value of having excellent and trustworthy partners who are well versed in their local markets and MSV. We shall continue our collaboration and support to those partners to achieve our common mission.

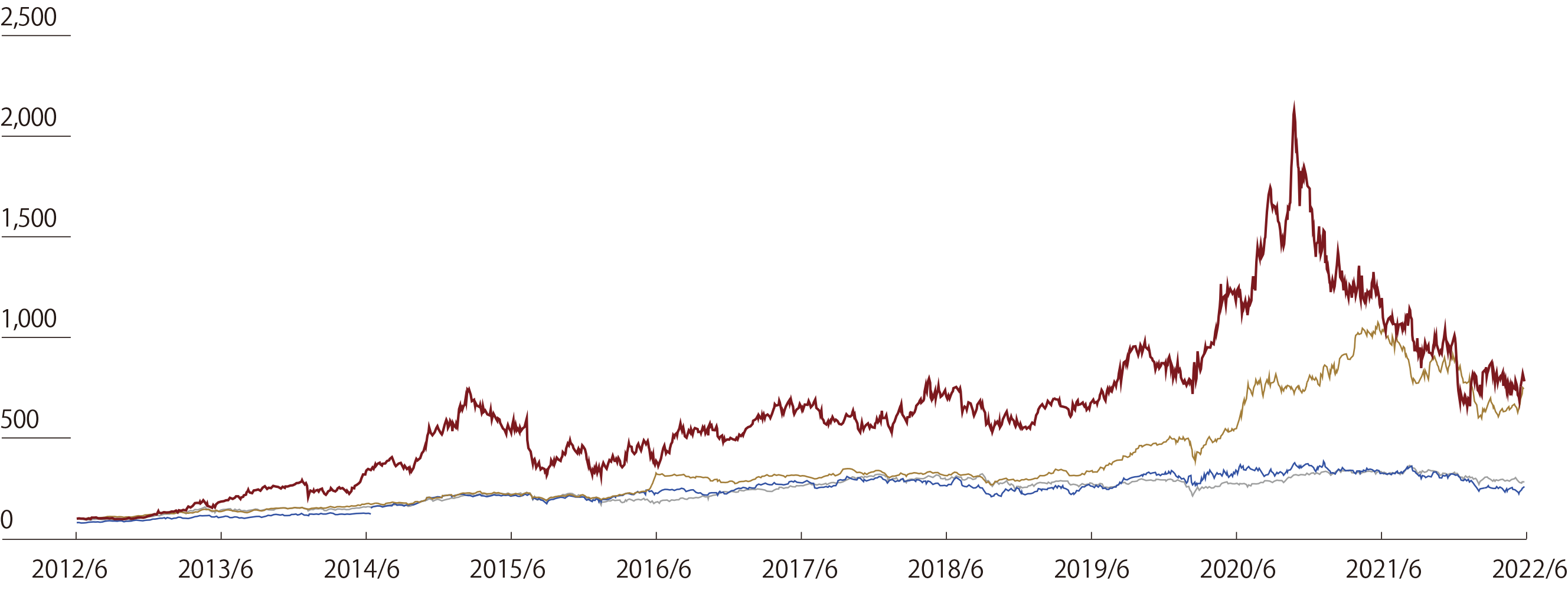

Our stock price, which is the outcome of MSV, has increased by 683% (see the chart below) over the past 10 years, outperforming the TOPIX chemical sector average and competitors. As a unique Asset Assembler, we will remain committed to MSV.

We appreciate the continuous support and guidance from our investors.

|

Historical stock price of NPHD  |

■NPHD +683% ■Average of competitors (average value) +649% ■The TOPIX chemical sector average +183% ■Average of competitors (mean value) +159% |

*1 Source: FactSet (as of June 30, 2022), Bloomberg

*2 NPHD stock prices, average of competitors (average value), average of competitors (mean value), and the TOPIX chemical sector average were indexed with the closing price on June 29, 2012, as 100

*3 Competitors covered are Sherwin-Williams, BASF, Asian Paints, PPG Industries, AkzoNobel, Berger Paints India, Axalta, SKSHU Paint, Kansai Paint, TOA Paint, Asia Cuanon

*4 Stock prices of Axalta, SKSHU Paint, TOA Paint, and Asia Cuanon were indexed using the indexed stock price of Sherwin-Williams on the listing dates of these stocks

August 31, 2022

Director, Representative Executive Officer & Co-President

Director, Representative Executive Officer & Co-President

Co-President Message Video

From "Press Conference: Change of Representative Executive Officer (Change of President)" on April 28, 2021

Related Page

Message from Co-President Wakatsuki

Director, Representative Executive Officer & Co-President

Message from Co-President Wee

Director, Representative Executive Officer & Co-President

- Integrated Report 2022 (Digital Edition)