Improving the profitability of Japan Group is one of our highest priorities. Under the leadership of Co-Presidents, we are implementing structural reforms of Japan Group by using unconventional approaches and actions.

On this page, Director, Representative Executive Officer & Co-President Wee Siew Kim explains the progress of structural reforms in Japan Group and the roadmap for improving its profitability.

Progress and achievements of structural reforms

The general consensus of the management teams in Japan Group is that bunshaka in 2015 was the root cause of the declining profitability of this segment from FY2017 onwards. Bunshaka split Japan Group along focused business lines of automotive, decorative, industrial, surface treatment and marine, coupled with a trading/procurement unit overseen by an operating/holding headquarter company. It was an excellent idea. However, bunshaka was not implemented with market competitiveness in mind, resulting in a bloated cost structure saddled with duplicative capabilities and cumbersome processes.

The total revenue of Japan Group is approximately JPY190 billion, with revenue at each partner company accounting for about JPY40 billion. Therefore, individual partner companies cannot afford to adequately invest in manufacturing facilities, operational systems, and human resources. Inefficiencies and falling profitability precipitated a vicious cycle of business loss and inability to further invest in staff development and aging facilities. Having agreed on the root problem, the first order of the day was to address these issues while preserving the core ability of the organization to continue to meet current and future customer needs. Eight task forces were launched to address specific aspects of production, quality, and SG&A elements of the larger PCs (see the table below.)

-

Theme Task Force (TF) Major achievements Production/

Quality1. NPAU Production TF

(Automotive)- Reduced cost by increasing the capacity utilization of in-house production factories and improving productivity

- Streamlined logistics and shipping and reduced storage cost

- Reduced labor cost by improving the efficiency of back-office operations

2. NPTU Production TF

(Decorative)- Completed restructuring and consolidation of production subsidiaries and streamlined management costs

- Improved human productivity and cost productivity by reforming production and logistics processes

- Started training core human resources who will perform the next-generation production and logistics functions

3. NPTU Production TF

(Industrial)- Started considering productivity improvement of inefficient products based on analysis of production man-hour by product

- Completed automated data visualization of all expenses incurred at factories

- Shifted to insource production of contracted products

SG&A 4. NPIU & NPMC SG&A TF

(Industrial/Marine)- NPIU and NPMC jointly rationalized SG&A expenses

- NPIU and NPMC jointly rationalized expenses by sharing part of functions of sales and administrative departments

- Rationalized NPMC’s supply chain management cost

5. NPAU SG&A TF

(Automotive)- Reduced the ratios of personnel expenses and SG&A by consolidating and streamlining tasks by integrating two or more departments

- Improved business processes by integrating sales and logistics functions which were separated into production and sales departments

- Eliminated overlapping tasks with NPCS in the areas including technology, HR, and general affairs

6. NPTU SG&A TF

(Decorative)- Strengthened collaboration and improved the efficiency of operations management following the integration and restructuring of affiliated companies

- Optimized and reallocated the workforce within the group

- Secured earnings by revising selling prices

Finance 7. BSC TF

(Cost Management Enhancement)- Visualized the impact of raw material price increases by product using ICT tools

- Strengthened alignment of budget and standard cost management and reflected the results to each product (responded to changes in management environment, such as increase in utility cost)

Procurement 8. NPMJ TF

(Procurement)- Reduced procurement risks by visualizing the procurement risk information and information of substitute raw materials

- Mutually shared product strategy and raw material selection strategy with other partner companies to implement highly effective measures. Contributed to the acceleration of cost reduction activities and earnings growth

Early results from the action plans implemented by these eight task forces borne out the belief that when cross-functional task forces of staff from all levels are properly challenged and empowered to solve problems, unencumbered by established constraints, many of the intractable issues can be resolved over time. This also demonstrated that the hidebound hierarchical, top-down culture that was dominant was also inhibiting the realization of the true potential of our workforce. In parallel, Nippon Paint Corporate Solutions (NPCS) was carved out of NPHD to house the functional competencies that are capable of addressing pan-Japan issues in supply chain, manufacturing facility footprint, talent development, core R&D, financial and audit. Cross Japan initiatives driven by NPCS were envisioned to break through the silos of the operating PCs.

In short, NPCS was created to bring out the true effectiveness of focused PCs based on business lines whilst having the ability to deliver cross-Japan efficiencies. Organizational restructuring inevitably results in many instances of roles being drastically altered or eliminated. To ensure that affected staff are fairly treated, Next Career Plan was implemented such that special early retirement options coupled with next career placement assistance were offered.

On the business front, besides the key leaders making determined efforts to dig deeper into the cost drivers of their business areas, appropriate financial information was made accessible to a broader group of people. As a result of the increased accountability and raised awareness, our leaders identified many opportunities for improvement. This was particularly timely when raw material costs escalated sharply in 2022, necessitating both further cost reduction (CR) efforts as well as the gumption to address cost pass throughs with customers with pleas for price increases. The CR and out-of-cycle price adjustments were in themselves clear indications of mindset changes on the part of our Japanese leaders.

Much remains to be done but the seeds planted in 2022 position us well to take on the challenges of 2023 and continue on our quest to regain the profitability of 2017-18 and thereby contributing to sustainable EPS growth.

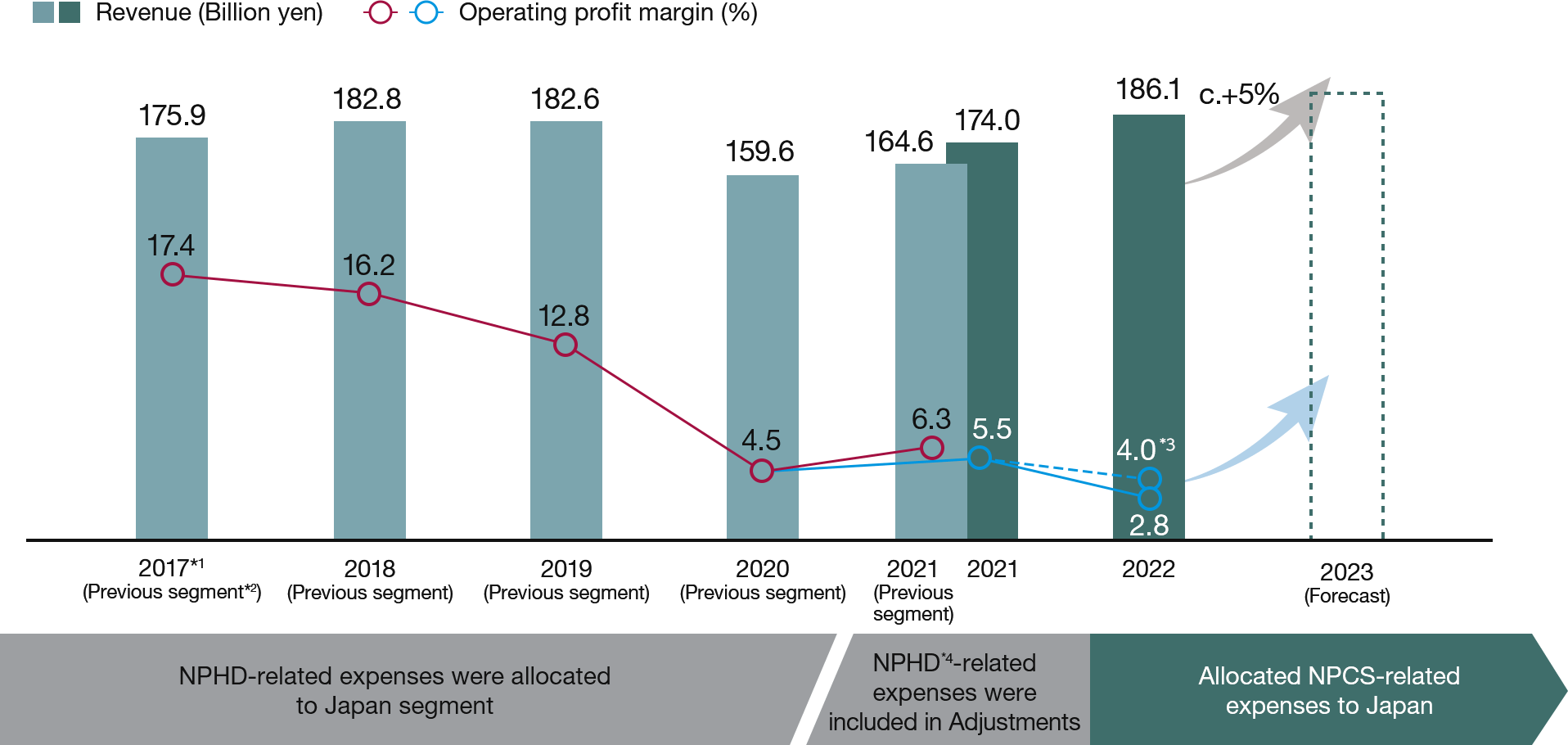

Operating performance of the Japan segment

*1 J-GAAP-based figures for 2017 (IFRS-based figures starting with 2018)

*2 Japan Group included marine business in Japan only under previous segment but also includes overseas marine business under new segment.

*3 Excluding special retirement payment of c. JPY2.2 bn

*4 Including the current NPCS

Enhancing communication with priority on the effects of transformations

Japan Group is improving employee engagement while paying attention to the effects of transformations too. According to the survey conducted by Nippon Paint Labor Union at the end of FY2022, employee satisfaction declined to 81%, decreasing for the second consecutive year. In response to this survey, we are taking actions such as providing workplaces where people can realize their full potential and designing a compensation structure that rewards excellent work. At the same time, we are reexamining our organization with the goal of increasing motivation. In addition, activities are underway to enhance communications, such as through messages from Co-Presidents and other senior executives whenever appropriate and management communications at partner companies.

Progress of reforms in the marine coatings and automotive coatings businesses

The marine coatings and automotive coatings businesses in Japan Group presented themselves as urgent candidates for attention because of the operating losses of both businesses. Both PCs share one common characteristic – customers who are operating globally but supported by Nippon Paint Group without having an adequate global support infrastructure and operating model. Both businesses also needed to simultaneously address domestic costs and inefficiencies issues whilst designing and putting in place the appropriate external wings. Marine and automotive PCs took different paths primarily because their problems were different.

Marine coatings business

For marine, the domestic cost structure and talent base were addressed with pulling together the resources of both Japan’s industrial and marine businesses. Senior industrial leaders from NPIU and business leaders from NIPSEA were coopted to lead the transformation. Careful rebalancing of our product portfolio in Japan, among new-build and maintenance & repair, and among customers, was conducted.

The entire product portfolio was also re-assessed with a view of delivering better formulation costs and value propositions. Sharper appreciation of the cost drivers enabled our sales leaders to obtain price increases from domestic customers. We believe the effort of 2022 will give a fighting chance for the domestic Japan marine business to turn a profit in 2023.

At the same time, the global supply chain organization has to be set up from scratch to deliver responsive supply on the back of a network of global supply points for our coatings and sea stocks so as to provide better coverage for our customers. This global network is still a work in progress.

Being a global business, senior marketing staff of NIPSEA worked with Japanese colleagues to bring to life new marketing material and sales tools, together with the confidence to exhibit at international marine shows. Outside of Japan, the overseas associates were restructured one at a time: merging some as in China, Taiwan, Singapore and Hong Kong; combining them with NIPSEA as in Malaysia, India, Indonesia; and downsizing and refocusing as in Korea.

The outcome is the first operating profitability in many years for the entire marine coating business segment in 2022. This builds the confidence that we can now turn our attention to be a truly global marine organization that aspires to meet the more environmentally exacting standards expected of all coating companies.

Automotive coatings business

The challenges confronting our automotive business were many and daunting. The shrinking share of market and operating loss situation were signs that we have both cost structure and technological issues. The latter was addressed with a restructuring of the entire Technology division with a joint Japan Auto-NIPSEA CTO (in an attempt to leverage NIPSEA resources whenever beneficial for stepping up progress) as well as giving more responsibilities to younger and energetic Japanese leaders who are unconstrained by the past. The result of the transformation in the technology division is particularly comforting in that Nippon Paint Group is now leading the field in the campaign for the next generation of carbon neutral requirements of one particularly important auto OEM customer. Although initial attention was focused on the technology side because of the recognition that we are falling behind our key competitors in this aspect, it was also recognized that we have to develop a whole new integrated sales-technical approach to the customer. Customer centricity was emphasized as we gave more accountability to sales leaders to ensure that in the new product design process (named DR +), sales leaders hold full accountability for target market costs and product specifications. Task forces in production/quality and SG&A in automotive PC attempted to derive efficiencies from a hitherto disparate collections of operating sites and offices. The intent is to bring together everyone to operate as one company and not as a hodgepodge of distinct divisions and sites. Additionally, we hope to see even better synergies as we cross-deploy talent from other PCs into our automotive production sites.

A much reduced operating loss was all that we can show in 2022. Nonetheless, even saddled with the pressure of increasing investments in new infrastructure and facilities, business costs in the globalization of our film business, as well as disruptions as we rejuvenate the auto parts business, Auto PC is well positioned to return to profitability in 2023.

Our path for reforming our culture and the mindset of our employees

Japan Group has long-standing traditions and a justifiably proud history. In order to keep pace with a rapidly transforming business landscape and pick ourselves up from the stupor of recent years, adjustments have to be made to our approach to work. The Japan-Lean for Growth (J-LFG) program was introduced. J-LFG is a cultural transformation initiative that aims to energize the entire workforce and promote a proactive approach to business with desired workplace behaviors. It encourages our people to adopt a different mindset about growth, pace and efficiency. This J-LFG program was developed with inputs from a broad spectrum of our Japanese leaders and staff. J-LFG is not solely about cost cutting which is a distinct departure from the singular focus of Survival Challenge. On the contrary, it embodies strongly the element of investment for growth. Coupled with the prerequisite of Leanness, which conjures the image of a muscular lean body that is fit for agility and growth, it draws upon the energies of the entire body of staff with the firm belief that everyone, at every level in the organization can do his or her part in contributing to leanness – eliminating waste and friction to free up the resources to chase growth.

I felt that many of our colleagues have begun to appreciate the significance of this program based on the feedback and observed anecdotal descriptions of J-LFG in practice in our workplaces. Cultural entrenchment takes time, and together we will persevere towards this lean and growth DNA. It is this cultural differentiation that we will bring to the marketplace as a competitive advantage.

Developing leaders who can contribute to continuous EPS growth

Building upon the J-LFG culture, sustainable and continuous EPS growth necessitates that we continually outwit the competition and deliver fresh attractive value propositions to the market. This requires an open mindedness to adopt and adapt ideas, innovations and practices different from the conventional. We have a rich pool to dip into as Nippon Paint Group’s diverse field of partner companies across the world offer up an extensive array of ideas and innovations. It must be recognized that the willingness to challenge the status quo and encouragement of contributory dissent are not exactly behavioral traits of our workforce, leadership or even society. To change requires courage. Courage is required of our leaders. In order to reset the default risk averse attitude, it falls upon the shoulders of our senior leaders to create an environment where sensible, calculated risk-taking is allowed and encouraged. Our employees must comfortably enjoy a level of psychological safety that free up any inhibitions. As we continue to demonstrate that we really mean what we say, and continuously listen and pay attention to the views of our staff from all levels, one day this will firmly take root. In time to come, as we continue to groom our young leaders in this mould, a wolf-like entrepreneurial spirit will infuse our organization such that the collective insatiable appetite of the entire workforce will propel us forward. Then, we would be unstoppable. Leaders must set the example. Leaderships must create the environment. It will take time for many of our colleagues to firmly believe that things are changing. In the meantime, we put in place the training and exposure for our people. In the past year, talent development, grooming initiatives and performance/behavioral-based incentives have been put in place as NPCS HR are realigned with PC HR to drive a multiyear effort in order that we take the tentative steps to groom our future workforce.