India Businesses Buyback from Wuthelam Group

In August 2023, our Board of Directors approved a resolution to repurchase two India businesses that had been part of the three businesses transferred to Wuthelam Group in August 2021. The third business, a European automotive entity, was not considered for repurchase. Prior to reaching this resolution, we sought an evaluation from an independent third-party entity, mirroring the process undertaken during the initial transaction two years ago. To ensure thorough consideration and protect the interests of minority shareholders, we established a Special Committee dedicated to this matter.

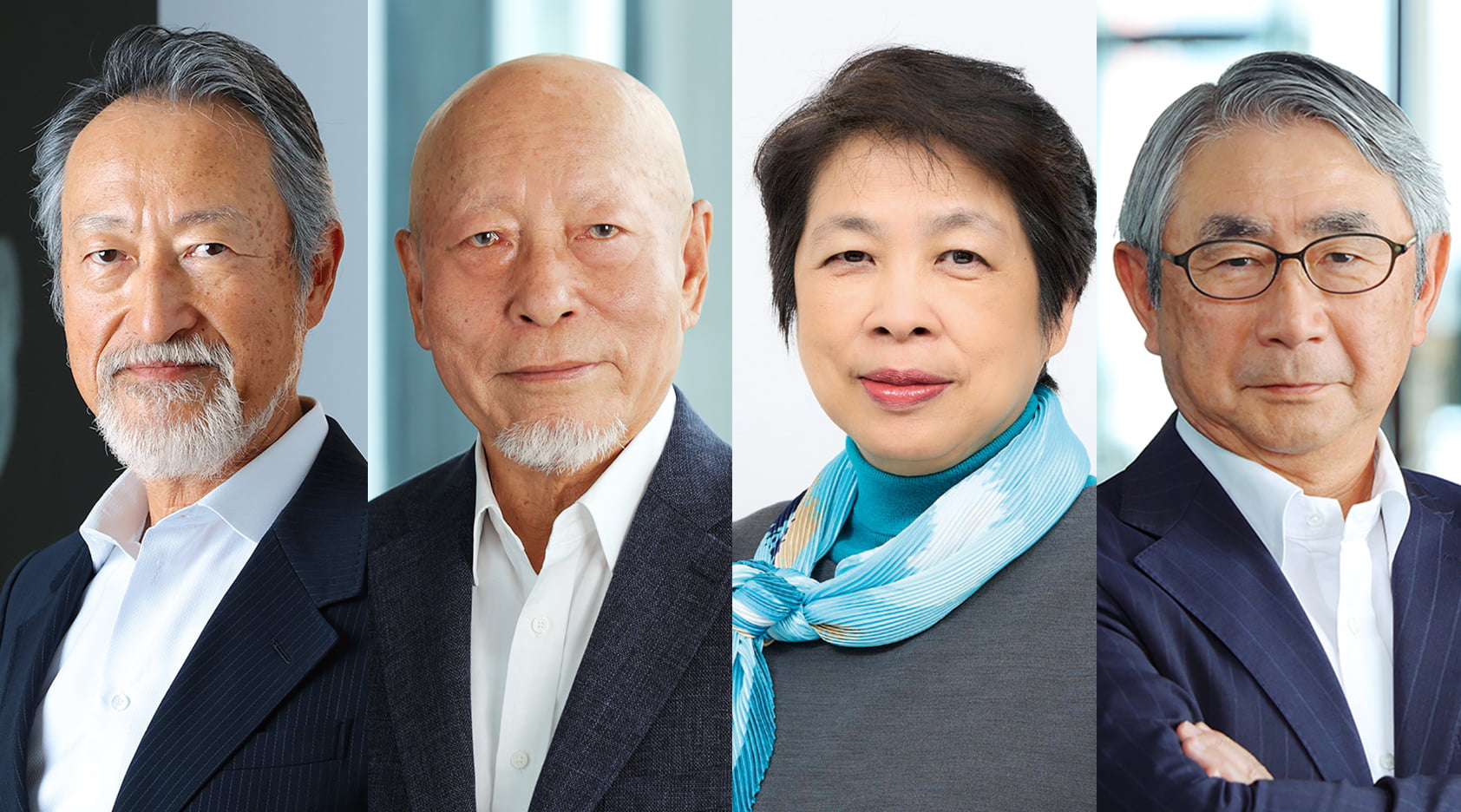

This section presents the key comments made by our Directors concerning this significant transaction.

* Please note that Director Goh, being an interested party, abstained from participating in all relevant meetings.

For more information on the discussions by the Board of Directors regarding the share transfer of the European automotive business and the two India businesses to Wuthelam Group in August 2021, please refer to the “Share transfer of the European Automotive Coatings Business and India Businesses” section on our website.

-

AThe catalyst for reevaluating our India businesses was a comprehensive review of our business portfolio following the full integration of the Asian joint ventures in 2021. Our relatively late entry into the rapidly growing Indian market resulted in us lagging behind major competitors in terms of growth and profitability. At the same time, the market saw an influx of new entrants from various sectors. We faced a critical decision: whether to continue investing to compete with these new and existing competitors. It became clear that any reduction in investment would result in losing our competitive edge. However, winning the competition would necessitate substantial investments in advertising and channel development, with no guarantee of success. Under these circumstances, we considered multiple scenarios, including independently restructuring the India businesses or selling them to a third party. Independent restructuring would entail a significant short-term financial burden. Given the complexities of the Indian market, we had reservations about whether such an allocation of capital, from a risk-return standpoint, would contribute to MSV. Conversely, selling the businesses to a third party would likely eliminate the opportunity to repurchase them in the future, potentially closing off a growth pathway for our Group in the region. With Wuthelam Group providing us with an alternative that assumes various risks and preserves future options, we determined that this was the optimal decision from the perspective of MSV and protecting the interests of minority shareholders compared to other restructuring proposals. Reflecting on the past two years, the performance of our India businesses has exceeded expectations in terms of profitability improvement and market share expansion, reinforcing our belief that the decision made at that time was indeed the right one.

-

AWith our Group continuing to provide management services to the India businesses, they have successfully implemented significant structural enhancements and aggressive promotional activities. After a period of losses, we began to see a pathway toward sustainable earnings growth. Specifically, in the two southern states where we are focusing our efforts in decorative paints, we have achieved both a significant increase in market share and profitability. Our high brand recognition is a key advantage, making autonomous and sustainable growth possible. Therefore, we determined that it is the right decision to buy them back now, before their earnings increase further and the repurchase price becomes higher. On the other hand, the European automotive business is still undergoing revitalization and is therefore not included in the scope of the buyback at this time.

-

AThe successful restructuring of the India businesses over the past two years has led to sustainable profit growth. As we look ahead at our future business plans, we believe that no additional capital injection will be necessary; the businesses can generate the required funds for production capacity expansion and advertising to sustain their growth. Additionally, they have an excellent local management team. By making adequate investments in promotion and other necessary areas, initially focusing on the two southern states, we believe we can outpace our competitors. To ensure confidence in our strategy, we currently have no plans to expand into the third and fourth states, but we are always considering future possibilities.

-

AMajor competitors have already launched aggressive campaigns, and the entrance of newcomers from non-paint sectors has intensified market competition. However, we are executing various strategies based on comprehensive competitor analysis to seize market share from these major players.

-

AThe European automotive business has not yet completed its performance improvement, even after two years. Factors such as the conflict in Ukraine, a sluggish European economy, and operational issues (given our role as the business operator entrusted by Wuthelam Group) have contributed to this delay. We have been managing the European automotive business with almost monthly performance reviews. We will consider a repurchase when the business reaches the break-even point and we are confident that sustainable profitability is achievable.

-

AIn our current business portfolio, each partner company is capable of achieving autonomous and sustained growth. Therefore, we believe the likelihood of resorting to such options, aside from these three underperforming businesses, is quite low.