|

Released March 16, 2022

Nippon Paint Group Medium-Term Plan Progress

Outline of Medium-Term Plan (FY2021-2023) Progress

Year 1 of Medium-Term Plan provided the foundation for our "Asset Assembler" model

which combines strong organic and M&A growth.

We will continue to fuel our insatiable appetite for medium- and long-term growth.

Aggressively pursue growth in paint and adjacency arena M&A, while also driving autonomous growth of existing Group partner companies*.

Established the basis for sustainable growth with small headquarters at the holding company and with reinforced governance.

The strength of our business model is predicated on high market share in each region with emphasis on autonomy and accountability.

Expect to achieve Year 3 revenue target of 1,100 billion yen one year early.

Despite the impact of higher raw material prices and supply chain disruptions, achieved effective operating profit growth excluding one-off items with contributions from Indonesia, selling price increases, and significant savings in Head Office expenses compared to the initial plan.

Well positioned to achieve Year 3 target of 140 billion yen operating profit and 45 yen EPS, driven by autonomous growth across the Group based on solid paint demand and market share gains, progress with selling price increases, and contributions from new acquisitions.

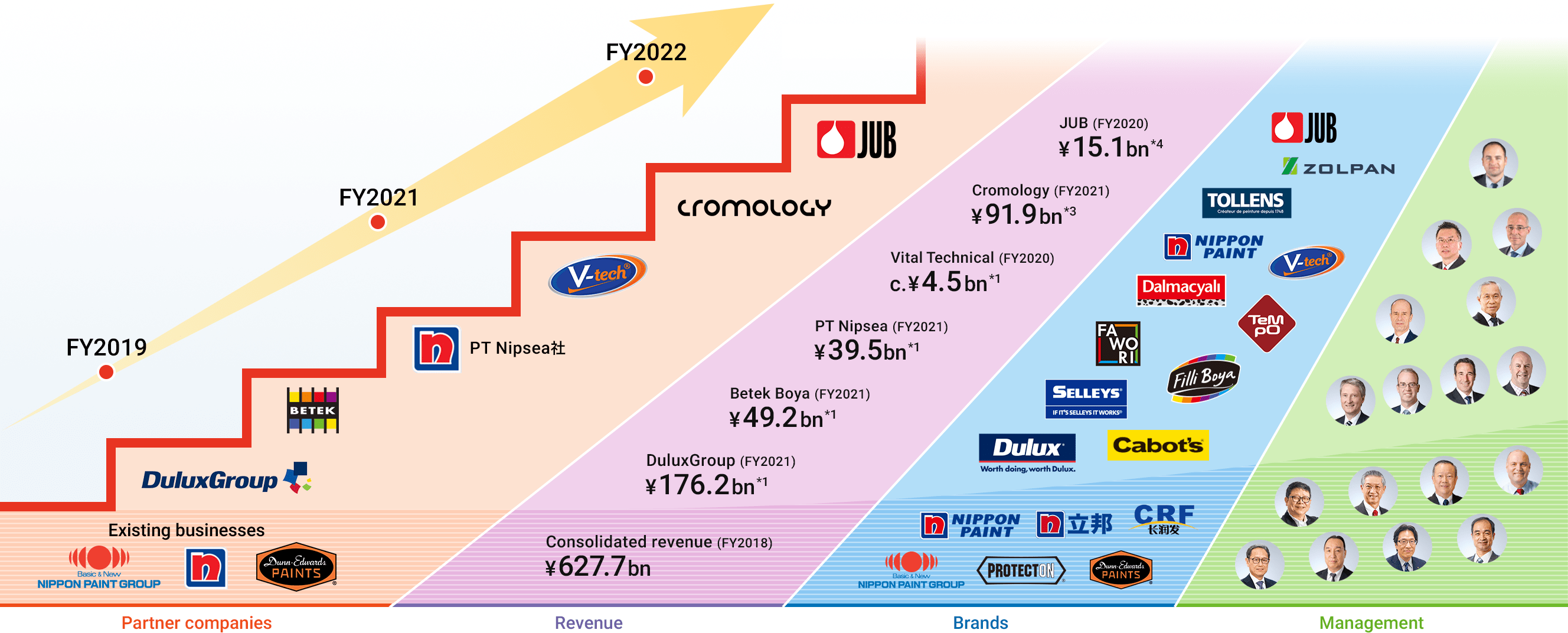

Asset Assembler

Nippon Paint is a unique Japan-based "Asset Assembler" with MSV as its sole mission

We have adopted a business model in which we, with a smaller headquarters at the holding company (NPHD), assemble assets focused on attractive markets in the paint and adjacency arena through M&A, while driving autonomous growth of the existing Group partner companies*, resulting in strong growth with limited risk. We call it the Asset Assembler model.

*Name of consolidated subsidiary companies of Nippon Paint Holdings

|

1. Focused on paint and adjacencies with significant market opportunities

|

|---|---|

|

2. Attractive risk-return profile of paint and adjacency arena

|

|

3. Japan domicile enhanced competitive strengths

|

|

4. An assembly of talented management and strong brands

|

|

5. Advanced governance

|

*1 SAF: Sealants, Adhesives, Fillers

*2 Source: Fortune Business Insights

*3 CC: Construction Chemicals

*4 Source: ReportLinker

On top of strong organic growth, we assemble assets with strong brand and excellent management through M&A, effectuating accelerated growth with limited risk.

Sustainable Growth Model as Asset Assembler

The key element of this model is that excellent management teams pursue autonomous growth in the Nippon Paint Group and exploit the technological strengths, distribution networks, purchasing capabilities, and financing capabilities of the Nippon Paint Group platform, rather than relying on initiatives of the headquarters. This will allow us to accumulate expertise in various areas and generate synergies as well as to attract new partners to the Nippon Paint Group.

By focusing on the paint and adjacencies markets, which are growth markets with the ability to generate sustainable earnings and cash, the Asset Assembler model allows us to accelerate growth with limited PMI (Post Merger Integration) risk involving M&A.

*1 On a segment basis (after elimination of intersegment transactions and after PPA)

*2 Exchange rate: MYR 1=JPY 26.55

*3 Exchange rate: EUR 1=JPY 132.79; Unaudited pro forma figures

*4 Exchange rate: EUR 1=JPY 131.05; The acquisition is scheduled for completion in 1H 2022

Strategy By Region And Business

FY2021-2022 Revenue/Growth Rate

| FY2021 Results (Tanshin) (Billion yen) |

FY2021 Growth Rate (In local currency) |

FY2022 Forecast (In local currency) |

Medium-Term Plan CAGR Targets* (In local currency) |

|

|---|---|---|---|---|

| Japan (excl. HD expenses) | 164.6 | +1.6% | +10-15% | c. +5% |

| NIPSEA China | 379.1 | +27.3% | +10-15% | c. +10% |

| Asia (Excepting NIPSEA China) | 151.1 | +74.9% | c. +10% | +5-10% |

| New consolidation (Indonesia) | 39.5 | +25.3% | c. +15% | c. +15% |

| Oceania | 176.2 | +5.9% | c. +5% | c. +5% |

| Americas | 76.4 | +4.9% | c. +10% | +5-10% |

| Other (Betek Boya) | 49.2 | +65.3% | +10-15% | +10-15% |

| Total | 998.3 | - |

12,000 (Tanshin) |

11,000 |

* Targets based on the New Medium-Term Plan (FY2021-2023) released on March 5, 2021

FY2022-2023 Actions

|

NIPSEA China Decorative (DIY) Business

|

|---|---|

|

DuluxGroup (Oceania)

|

|

Betek Boya (Turkey)

|

|

PT Nipsea (Indonesia)

|

|

Japan Business

|

|

Automotive Coatings Business

|

|

Paint Related Business

|

*1: Computerized Colour Matching

*2: Brand for adjacencies products such as adhesives and sealants

*3: External Thermal Insulation Composite System

Sustainability Strategy

Progress & Further Plan of Materiality

|

|

|

|

|

|

|

|

|

|

|

*1: Scope1 & 2; intensity basis

*2: Disclosed Scope 3 GHG emissions from our operations in Japan in the Integrated Report

*3: Life Cycle Assessment: A method of quantifying the environmental impacts across the entire life cycle of a product

*4: Our unique framework that integrates the sustainability perspective in product development

M&A Strategy

Continue to pursue aggressive M&A strategy by leveraging our autonomous and decentralized business model

Our Asset Assembler model is not based on global standardization and common cost reduction programs, but rather pursues autonomous growth by assembling excellent companies with potential for a sustainable EPS contribution. We encourage collaborations with existing Group partner companies around the world and allow the use of financial resources provided by NPHD. We believe this is the right model to create medium- and long-term value in the paint and adjacencies businesses, which are characterized by local production for local consumption.

② Geography: Not limited

③ Potential targets: Strong corporate/product, brand and excellent management team

① Fundamentals of paint and adjacencies markets e.g. population growth and urbanization create enormous growth opportunities

② No restrictions in terms of target locations as long as acquisition contributes to MSV. Distant location to be carefully examined

③ Continue to assemble assets leveraging strengths of our autonomous and decentralized business model

② Ability to finance in Japan, with stable currency and stable market

③ Full access to the Nippon Paint Group’s platform

④ Excellent management teams enabling autonomous and decentralized business model

① Stable cash generating ability and strong financial position

② Low interest rate borrowings, safety and liquidity of the stock market

③ Sharing expertise, products, and technologies within the Group

④ Minimize the PMI risk

② ROIC*1>WACC*2

③ Sufficient leverage capacity

④ Debt financing prioritized; equity-based capital raising remains an option

① Aim to achieve EPS accretion in Year 1 after acquisition

② Take capital efficiency into consideration

③ Secure financial soundness to prepare for future M&As

④ EPS accretion also a must in rare case of equity financing

*1: Return on invested capital (after one-off expenses)

*2: Weighted average cost of capital

Related Materials of Nippon Paint Group Medium-Term Plan Progress