The five strengths underpinning our Asset Assembler model

1. Focused on paint and adjacencies with significant market opportunities

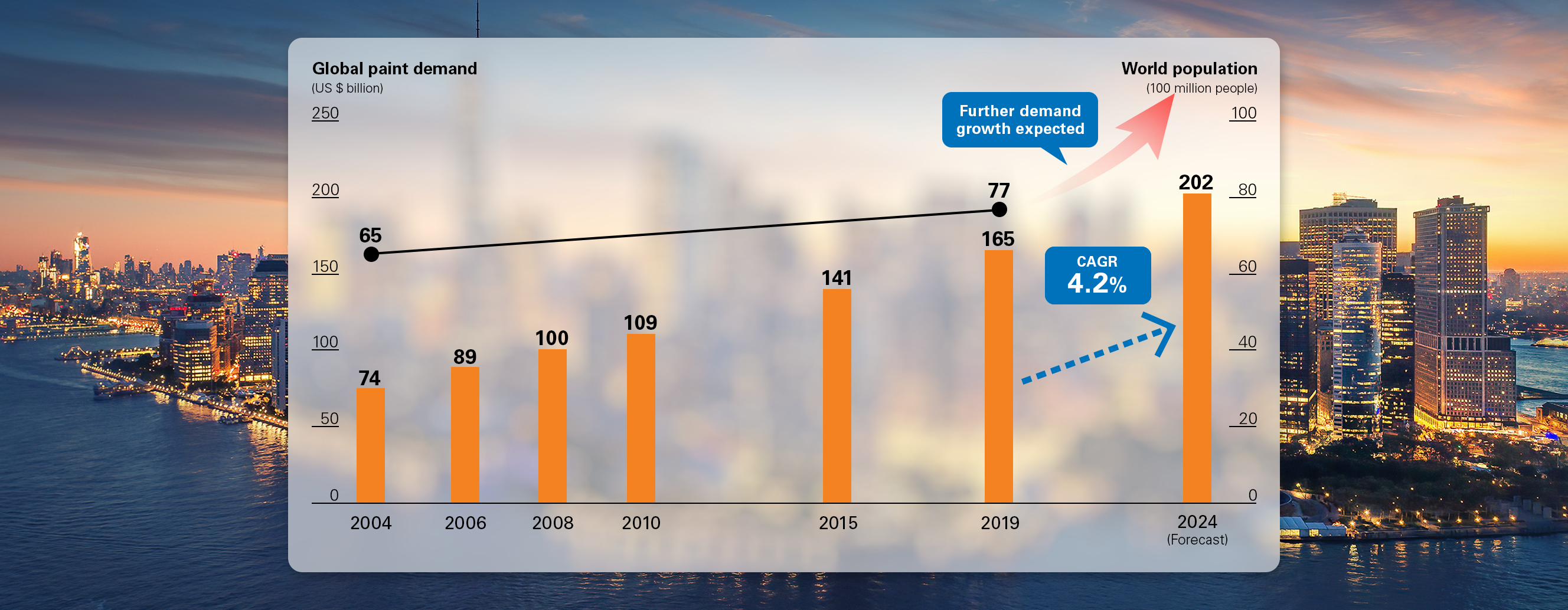

Global paint demand*1,*2

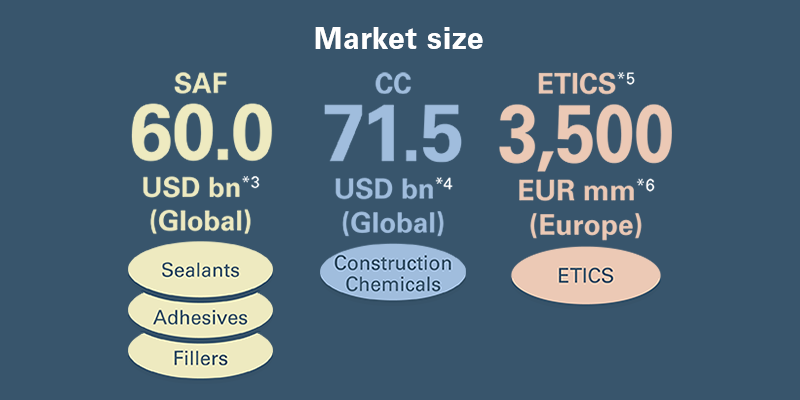

We are focusing on paint and adjacencies that have significant market size and growth opportunities driven by population growth, per-capita GDP growth, and urbanization. We have considerable expertise and knowledge in these areas. The adjacencies market, represented by the sealants, adhesives & fillers (SAF) and construction chemicals (CC) also boasts an attractive market size, and we have established a one-stop platform to supply adjacencies products, in addition to paint products.

*1 Country/region total figures are market growth forecasts in 2019.

*2 Source: ACA-published Global Market Analysis for the Paint & Coatings Industry (2019-2024) https://paint.org/market

Demand for paint as an essential component of social infrastructure steadily rises with population growth and economic development

Population:United Nations, Department of Economic and Social Affairs, Population Division (2019). World Population Prospects 2019, Online Edition. Rev. 1.

Paint demand:ACA-published Global Market Analysis for the Paint & Coatings Industry (2019 -2024); https://paint.org/market

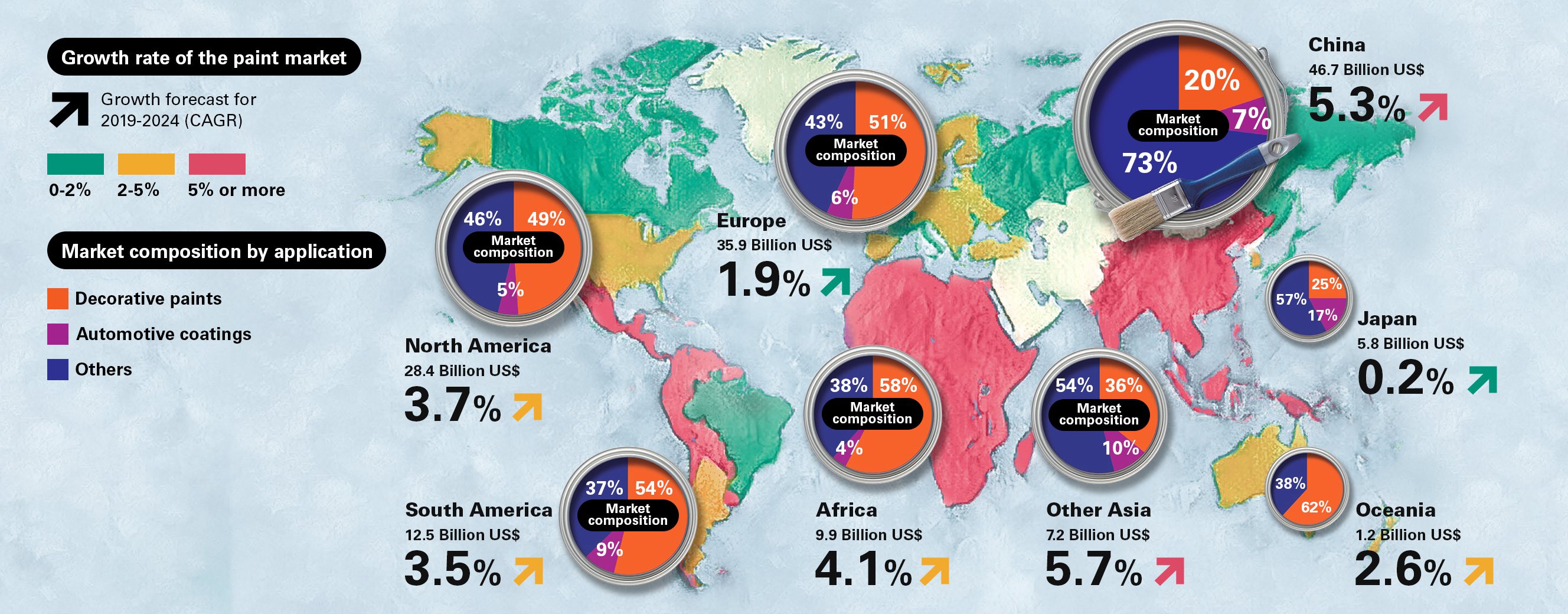

The paint market offers potential for sustainable growth worldwide

We expect the economic growth and accompanying urban development in China and other Asian regions to support continuous market growth through the medium and long term, mainly in the decorative paints field that supports infrastructure development such as housing and buildings.

Source of data: ACA-published Global Market Analysis for the Paint & Coatings Industry(2019 -2024), https://paint.org/market

Note: Country/region total figures are market growth forecasts in 2019.

2. Attractive risk-return profile of paint and adjacencies arena

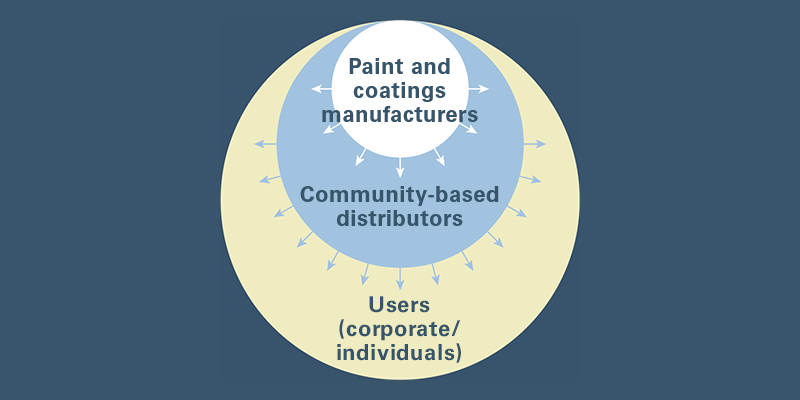

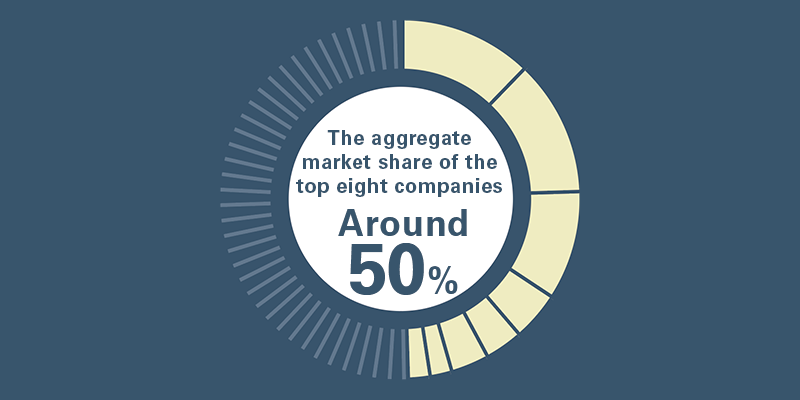

Our powerful brands and high market share in the paint and adjacencies markets have raised entry barriers and enabled us to establish a solid leading market position. The paint and adjacencies markets are highly localized, characterized by local production for local consumption with strong local features, allowing us to minimize PMI risk through autonomous and decentralized management. These markets are also characterized by attractive returns with limited risk, where we can expect profit and cash flow generation with some degree of certainty. These characteristics make the paint and adjacencies markets well suited to M&A.

- Characteristics of the paint and adjacencies businesses

-

-

Businesses characterized by local production for local consumption Customer needs differ across countries and regions

-

High entry barriers A small number of top-ranking brands dominate the markets

-

Adjacencies have several areas of attractive markets We supply both paint products and adjacency products in a one-stop fashion

-

*3 Source: Fortune Business Insights

*4 Source: ReportLinker

*5 External Thermal Insulation Composite System

*6 Source: European Commission Paper

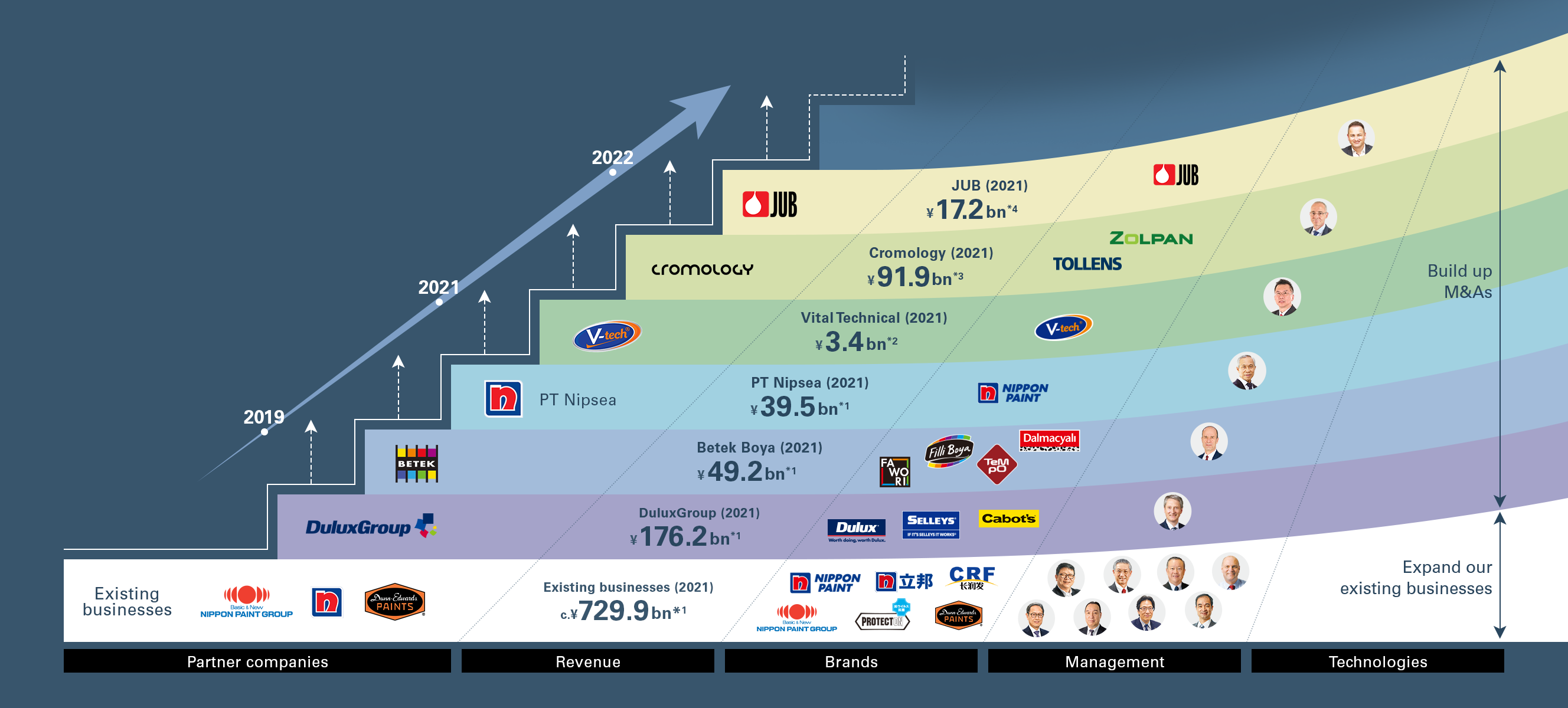

3. An assembly of talented management and strong brands

*1 On a segment basis (after elimination of intersegment transactions and after PPA)

*2 Vital Technical's revenue represents its nine months of revenue; Exchange rate: MYR 1=JPY 26.61

*3 Exchange rate: EUR 1=JPY 132.79; Pro forma figures

*4 Exchange rate: EUR 1=JPY 135.19

Our focus on paint and adjacencies allows us to create greater-than-expected synergies from strengths brought by an assembly of talented management and strong brands. Management of partner companies have a deep understanding of market features in their operating regions and are well versed in MSV, and with our autonomous and decentralized management, they can fully utilize their abilities. Unlike Western models featuring standardization and cost-cutting synergies, this model can leverage the strengths of our partner companies in this industry, which is highly localized. We believe this model makes joining Nippon Paint Group more attractive to potential partners as well.

Autonomous and decentralized management based on strong Trust in partner companies

Nippon Paint Group is pursuing autonomous growth through collaboration and cooperation among Group partner companies in each region based on autonomous and decentralized management based on Trust with our partner companies around the world.

Our mainstay decorative (architectural) paints business features local production for local consumption. For this reason, NPHD exerting blanket control over the Group’s wide palette of businesses would not be effective. Conversely, providing a platform for our Group companies to share and learn from each other is the most effective way to generate Group synergies.

NPHD plays a governance role for the Group, including appointing and dismissing Group partner company CEOs and overseeing financial strategy, but the individual companies are responsible for executing their own autonomous initiatives to create synergies among the Group’s partner companies.

Aggressively pursue new partners to join our Group, taking advantage of the growth potential of the paint market and stability of cash flows

Key points of our M&A strategy

② Geography: Not limited

③ Potential targets: Strong corporate/product, brand and excellent management team

① Fundamentals of paint and adjacencies markets e.g. population growth and urbanization create enormous growth opportunities

② No restrictions in terms of target locations as long as acquisition contributes to MSV. Distant location to be carefully examined

③ Continue to assemble assets leveraging strengths of our autonomous and decentralized business model

② Ability to finance in Japan, with stable currency and stable market

③ Full access to the Nippon Paint Group’s platform

④ Excellent management teams enabling autonomous and decentralized business model

① Stable cash generating ability and strong financial position

② Low interest rate borrowings, safety and liquidity of the stock market

③ Sharing expertise, products, and technologies within the Group

④ Minimize the PMI risk

② ROIC*1>WACC*2

③ Sufficient leverage capacity

④ Debt financing prioritized; equity-based capital raising remains an option

① Aim to achieve EPS accretion in Year 1 after acquisition

② Take capital efficiency into consideration

③ Secure financial soundness to prepare for future M&As

④ EPS accretion also a must in rare case of equity financing

*1: Return on invested capital (after one-off expenses)

*2: Weighted average cost of capital

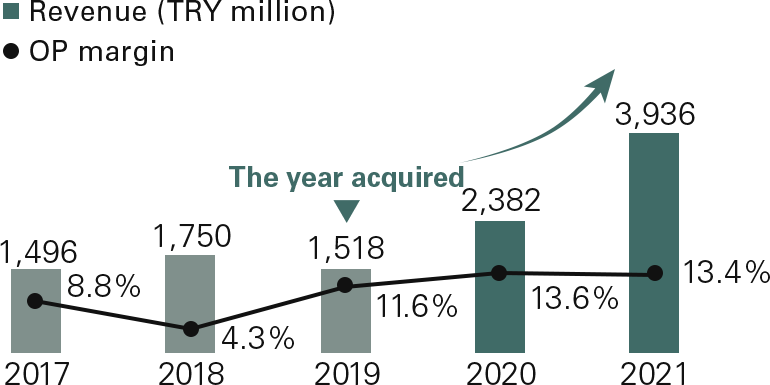

M&A best practice: Betek Boya

Achieved revenue growth and OP margin improvement under Nippon Paint Group

Betek Boya

Acquired in July 2019

| Pre-acquisition | Post-acquisition | |

|---|---|---|

| CAGR | 0.8%*1 | 61.0%*2 |

| OP margin | 11.6% (2019) |

13.4% (2021) |

Synergies generated

based on our

autonomous and

decentralized management

- Betek Boya utilized NPHD’s low-cost fund-procurement capability to repay its entire high interest rate borrowings and allocated cash generated to aggressive investment in marketing activities, achieving market share gains (FY2019: 27%→FY2021: 34%*3)

- The acquisition enabled Betek Boya to share business growth know-how and best practice in developing countries as a member of NIPSEA Group and vice versa, achieving growth that significantly outperforms its pre-acquisition CAGR and the market growth

- Significantly reduced raw material cost in the first year following acquisition by sharing NIPSEA Group’s raw material procurement sources

- Stepped up its multi-brand strategy through successful launch of new brand for its premium line by using high-profile NIPPON PAINT brand

- Shared Betek Boya’s know-how in the ETICS business in the adjacency area within Nippon Paint Group, which led to faster growth of the ETICS business in our operating regions

*1 CAGR is for FY2017 to FY2019

*2 CAGR is for FY2019 to FY2021

*3 NPHD’s estimates

4. Japan domicile enhanced competitive strengths

In Japan, which has a stable currency and safe market, we can finance at low interest rates based on long-term relationships with and strong support from financial institutions. This gives us a unique strength unmatched by our global competitors.

5. Advanced governance

We have established an advanced and substantively effective governance structure with Independent Directors comprising the majority of the Board of Directors. The Board of Directors shares with our major shareholder the achievement of MSV as the top decision criteria, ensuring the protection of the interests of minority shareholders. This constitutes a unique strength in our governance.

Basic approach to governance

We have shifted to a Company with a Nominating Committee with the aim of enhancing transparency, objectivity and fairness of management as well as separating and strengthening supervision of management and business execution. We, based on the Purpose as the significance of existence common to the Group and the Business Philosophy, which is its policy, promote its business and engage in ongoing efforts to enhance and strengthen its corporate governance, and thereby, will achieve “Maximization of Shareholder Value,” as its ultimate objective.

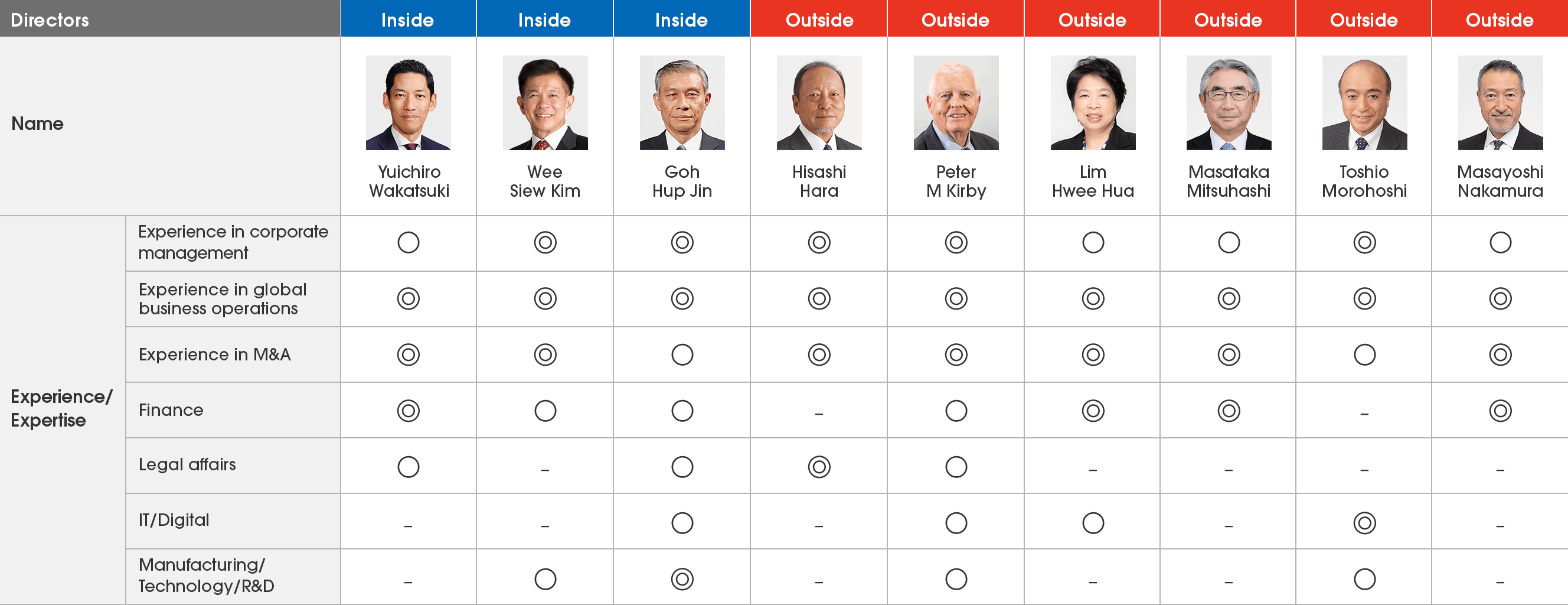

Our attitude to the composition and skills of the Board of Directors (Nomination, qualification criteria, diversity, etc.)

We believe that the Board of Directors and each Committee need to be comprised of Directors with a suitable background with the aim to establish the Board of Directors that is capable of performing the supervisory function in a sustainable manner in an ever-changing business environment. We have designated the three categories of “Experience in corporate management,” “Experience in global business operations” and “Experience in M&A” as required experience and the four categories of “Finance,” “Legal affairs,” “IT/Digital” and“Manufacturing/Technology/R&D” as required skills. We nominate Director candidates to form the Board of Directors comprised of members well balanced in terms of the above seven categories, and also appoint suitable Directors for each Committee that requires a higher degree of specialization. Experience in ESG-driven management, which has attracted attention in recent years, is included in “Experience in corporate management” as being able to supervise and make advise concerning a broad range of matters on overall management. Skills in GRC (Governance, Risk management and Compliance) are included in “Legal affairs.”

On the other hand, to ensure diverse opinions and supervisory functions at the Board of Directors, we endeavor to secure, expand and reinforce diversity based on a skill matrix without too much regard to particular attributes, such as age, nationality and gender.

Committee Composition

| Nominating Committee |

|

|---|---|

| Compensation Committee |

|

| Audit Committee |

|